Medium Banks Become a Top Competitor for Large Financial Institutions in Business Banking

Joel Mueller

Managing Partner and Research Director

Posted: Mar 27th, 2025

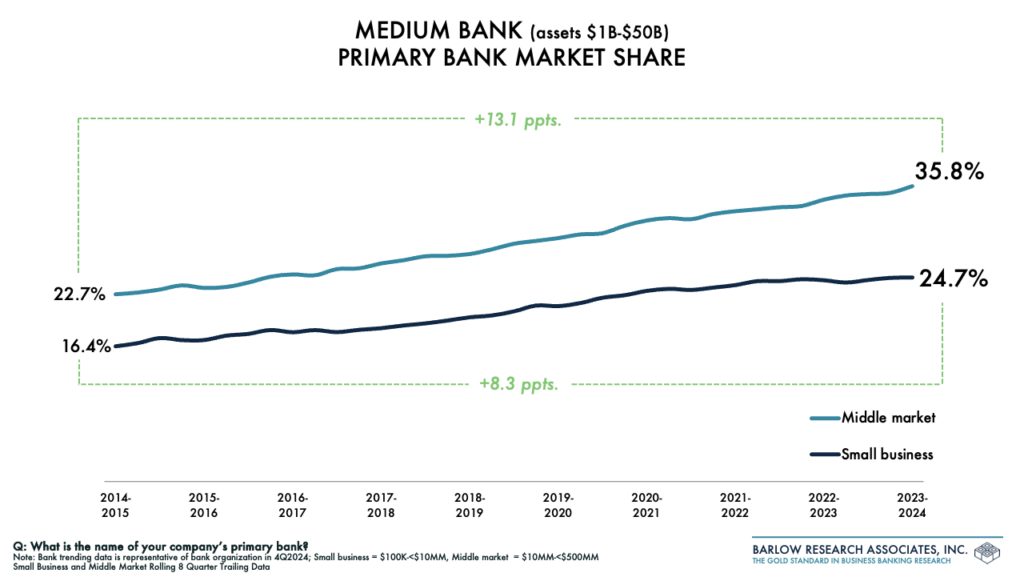

According to Barlow Research’s latest rolling eight-quarter data, medium banks (institutions with $1B-$50B in assets) are steadily gaining ground in primary bank market share in both small business and middle market segments. Currently, medium banks control 25% of the primary bank market share in the small business segment (companies with $100K-<$10MM in annual sales) and 36% of the primary bank market share in the middle market segment (companies with $10MM-<$500MM in annual sales).

In the small business segment, medium banks have increased their market share by 8.3 percentage points (see chart below). The shift is even more pronounced in the middle market, where medium banks have gained 13.1 percentage points. Despite these advances, large banks (those with assets exceeding $50 billion) continue to lead, holding 54% of the small business primary bank market share and 52% in the middle market.

Interestingly, the rise of medium banks has been mirrored by a decline in primary bank market share of small banks (assets under $1 billion) in the small business segment. This suggests that acquisitions of small banks partially account for the growth of medium-sized institutions (especially in the small business segment). However, not all gains are attributable to mergers and acquisitions. In the middle market, in particular, large banks have also experienced declines in primary market share, indicating broader competitive shifts.

Differences that set medium banks apart

Several factors distinguish the customer experience at medium banks from that of larger institutions. One prominent difference lies in the branch experience. Business customers at medium banks tend to be more frequent branch users and report higher levels of satisfaction with their branch experience. On average, medium bank small business branch users visit their branch seven times per month compared to only four times per month among large bank branch users. Similarly, medium bank middle market branch users visit eight times monthly (one more visit on average than large bank customers). These frequent interactions foster stronger, more personal relationships. As a result, medium banks often excel in key relationship-focused attributes like understanding business objectives and cash flow needs.

Digital channel usage is another area of differentiation. While the majority of business touches occur online or through a mobile app, medium bank customers remain comparatively less reliant on digital channels. At medium banks, nearly two-thirds of small business touches and 72% of middle market touches occur online or via mobile banking. Large banks see an even high proportion of customer touches originating in digital channels. Despite this difference, customer satisfaction with digital banking remains on par between medium and large institutions across both business segments.

One of the primary differences between medium and large bank customers is in product usage among small businesses. Small businesses that have a medium bank as their primary use one less product on average at their primary bank than large bank customers. Although small business medium bank customers appear generally satisfied with their bank, the question becomes: do medium banks have a large enough product arsenal to service small businesses as their companies grow and needs evolve? A recent Barlow Research study of medium bank customers found that over half of small businesses anticipate their banking needs will change over the next five years, and 88% of small businesses expect their primary bank to be able to address their future banking needs.

Three things to remember:

- Medium banks are gaining primary bank market share in both the small business and middle market segments, driven by a mix of organic growth and acquisitions.

- Medium bank business customers tend to use branches more frequently and report higher satisfaction.

- While digital engagement and product depth remain areas to watch, medium banks are largely meeting current customer expectations but need to be vigilant of evolving business client needs.

Barlow Research is proud to have recently rolled out our Business Banking Blueprint Program which is specifically focused on equipping financial institutions with valuable market intelligence to examine the unique challenges businesses face throughout their lifecycle from inception to growth and maturity, to succession planning. For more information about this body of work, please contact insights@barlowresearch.com.

For more information about this article, email Joel Mueller at jmueller@barlowresearch.com.