Enable Your Middle Market RMs to Convert New Deposits to Full Relationships

Mary Kay Schneider

Founder of MK Insights2Action, LLC

Posted: Aug 1th, 2024

Middle market (businesses with $10MM-<$500MM in annual sales) RMs often focus on cultivating referral sources to introduce them to potential new corporate borrowers. It’s an effective strategy, given that most bank loan agreements require the borrower to keep funds on deposit. But how much time are your RMs devoting now to those new commercial deposit accounts that were opened during the height of the banking crisis in 2023? A Barlow Research study published in May 2024 found that 31% of middle market companies opened a new account or moved substantial deposits from their primary bank. Likely, you have lost some of those relationships while gaining others. This article will dive into the importance of acting now to strengthen those new relationships, the need to get the whole team (sales, product, credit, and marketing) involved and aligned to the strategy, and how to develop and implement a thoughtful, nimble DRIP marketing strategy to support RM efforts to enhance these relationships.

The Time to Act is Now

Let’s look at what drove the decision to move money. At the time, it seemed driven to reduce risk and improve FDIC coverage. In the recent survey, decision-makers told Barlow Research that they moved funds for the following reasons:

- 55% were seeking a higher yield on their funds,

- 28% wanted to maximize their FDIC coverage

- 21% had a poor service experience

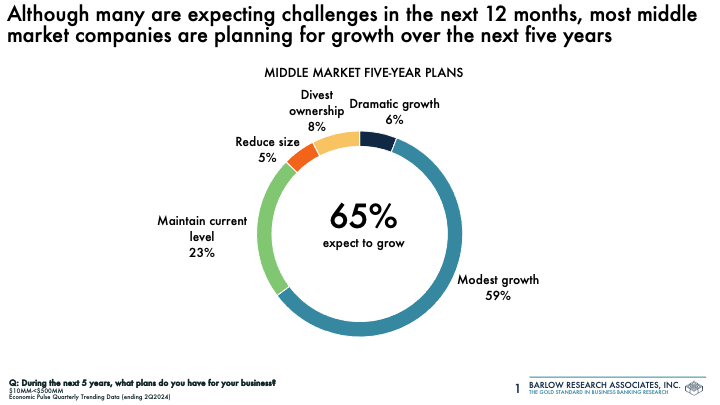

Now that they’ve moved money to your bank, how are you assessing your risk of losing these funds if you can’t offer greater value? Know that 20% of these decision-makers have shared that they are likely to open a new deposit account in the next six to twelve months. Offering valuable TM and merchant services solutions increases the functionality of these deposits and adds fee income to the deposit margin revenue. Can you help the business with an upcoming need to borrow for working capital or equipment? Businesses with $10 million to $500 million in annual revenues have had stable demand for additional credit. These businesses are most likely to expect to borrow to support equipment purchases and working capital as their cash reserves have diminished. The chart below shows that 65% of middle market companies are planning for growth.

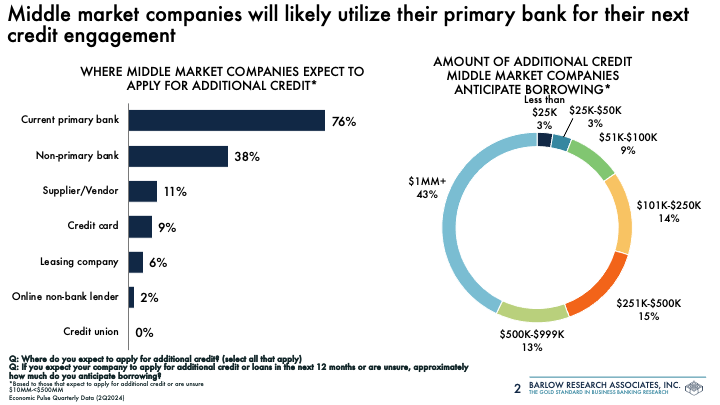

The growth will flow through the deposit accounts and increase the unit volume of transactions and how they are conducted. RMs should invest time in understanding how the business manages its cash flow and offer ways to improve it, leveraging treasury and merchant processing solutions and valuable information reporting to improve decision-making. Some of this growth will also require additional credit, and banks will receive many of these requests.

To help identify specific use cases where real-time payments could make sense, Barlow presented four scenarios to small businesses and asked them to indicate their likelihood of using real-time payments in each of these scenarios. As seen below, the most compelling use case among small businesses was to use real-time payments to receive high-dollar value payments from customers without incurring credit card fees, which garnered a 60% very likely to use score. The second most likely scenario was the ability to transfer money between accounts at different financial institutions in real-time with a 50% very likely to use rating among small businesses. The ability to pay suppliers or pay employees in real-time were not as desirable, with only 36% and 17% very likely to use, respectively.

Your bank’s internal product profitability model can help you see the value of this undertaking from a net interest income and fee income perspective.

It Takes the Whole Team to Deliver

RMs are most effective when they can leverage the talents of the whole team: all Product Partners, Credit Risk Management, Marketing/Sales Enablement and Sales Leaders.

For Relationship Managers:

- Become a trusted advisor.

- Be knowledgeable about the outlook for your company’s industry, the challenges and opportunities it faces, and insights into how your bank’s solutions solve specific business problems.

- Conduct efficient call prep and follow-up, leverage resources to improve productivity and importantly, be responsive to client questions and servicing needs. Business owners say that they want their Relationship Manager to be a proactive, capable, and competent partner who understands their business needs. They are looking for someone who can remove the red tape and share ideas, such as how to save money or increase the interest on their funds.

For Sales Leaders:

- Identify and address obstacles to solving clients’ business problems and delivering top-notch customer service.

- Dedicate time to helping your team with effective pre-call planning and visiting clients to help drive performance.

- Teach, coach, and share what is working/not working up, down and across the organization. Be sure to celebrate successes!

For Marketing/Sales Enablement: provide timely and relevant industry-specific insights which you may obtain from vendors or trade associations, incorporate your bank economist economic forecast, and share survey information on the outlook/expectations for middle market companies. RMs can use this to have more meaningful conversations with middle market decision-makers. Create website content for middle market industries and their business challenges and opportunities. Use emails/direct mail to drive visits to this content, and measure the opens, clicks, and time spent on specific messages to assess interest and relevancy. Provide leads to the RMs from this effort and track outcomes.

For Product Partners: support RMs with products designed to achieve client expectations, provide resources that assist RMs with call prep and joint calling to present the right solutions, provide customer-friendly implementation and white glove service. Regularly converse with the RMs to stay updated on competitor actions across your geography.

For Credit Risk Management: educate RMs on deal risks and how a request fits within the organization’s risk appetite. Offer viable solutions and deliver timely credit decisions.

Create and Implement a DRIP Strategy

A DRIP Strategy is a constant flow of communication that Differentiates your organization and the individual sender, Reinforces your commitment to the recipient’s success, Informs the audience of a particular challenge or opportunity, and Persuades them to respond and request information or a meeting. While often used for prospecting purposes, it’s a great way to stay in front of your clients and showcase your capabilities. Develop relevant and meaningful content and delivery options, including emails and printed materials that an RM can hand deliver, social media scripting and personally signed direct mail pieces. A successful DRIP strategy entails:

- Centralized creation to achieve consistent messaging

- A test and learn mindset – starting small and building on success

- Tracking and measuring execution (emails, visits, responses, product sales)

- Gathering feedback for future changes.

Be on the lookout for potential obstacles, such as competing priorities, and develop mitigation plans. Share successes broadly and recognize top performance. Based on feedback, implement changes to improve the content and delivery.

Key Takeaways to Convert Parked Deposits to Full Relationships

- The time is now to act and convert these new accounts into fully functional relationships. According to new data from Barlow Research, new business depositors (under two years) report lower overall satisfaction vs. established depositors of 5 years or more at 58% vs. 63% and lower Net Promoter Scores at 40 vs. 45. It’s time to act and close that gap.

- Get every role that supports your commercial client base on board and aligned with the strategy

- Execute a thoughtful, nimble DRIP marketing strategy, measure results, modify and repeat

About MK Insights2Action, LLC

MK Insights2Action, LLC provides financial institutions and nonprofit organizations effective strategies to increase revenues and manage risk. The firm leverages Mary Kay’s deep and broad experience in senior leadership roles in Retail Banking, Business Banking, Wealth Management, Commercial Credit and Lending Operations. In these roles, Mary Kay focused on supporting the personal and business financial needs of owners and decision-makers. Nonprofit organizations benefit from her director and executive committee experiences with emphasis on governance, board recruiting and fundraising. Visit https://mkinsights2action.com to learn more..

Mary Kay Schneider

A results-oriented financial services executive who has led bank sales, credit and lending teams to deliver relevant solutions to clients, helping them achieve their personal and business goals. She is a creative and strategic thinker, a relentless problem solver and excellent communicator. She is a former Gallup Great Workplace Leader and has led efforts to provide greater capital and advice to women business owners over her career. She is the founder of MK Insights2Action, LLC, the mother of two adult daughters, and resides in Cleveland, Ohio with her husband.