Interest Exists for Real-Time Payments Among Small Businesses

Youa Yang

Managing Partner and COO – Barlow Research

Posted: July 17th, 2024

It has been nearly one year since The Federal Reserve’s FedNow® service went live and almost seven years since The Clearing House’s (TCH) RTP® network became available. Currently, each of these organizations has an impressive list of participating banks and service providers that continue to grow. As financial institutions and service providers try to decide which network(s) to subscribe to, it will be critical to ensure the business customer is central to the process.

Since both the RTP® network and FedNow® service have been in place for varying timeframes, it’s apparent that not all small businesses ($100K-<$10MM in annual sales) have been receiving communications from their bank providers about real-time payments. Barlow Research surveyed small businesses in March 2024 to learn more about business customers’ experiences and opinions of real-time payments. Regarding communication (e.g., emails, mail, phone calls, texts, etc.) from bank providers about real-time payments in the last six months, the data revealed that only 17% of small businesses reported receiving any communication.

From a deployment perspective, according to Barlow’s Digital Business Banking Test Drive of 14 top U.S. financial institutions, Chase stands out as the only institution currently offering a real-time payment solution via online banking for small business customers. With this information, we can hypothesize that there are still many questions about the adoption of real-time payment technology and in particular how real-time payments fit into the existing ecosystem of payment vehicles (bill pay, ACH, wires, cards, Zelle®, etc.).

Further, despite financial institutions’ limited marketing and product deployment efforts among small business customers, Barlow’s research data shows that among small businesses that do not currently use real-time payments, 66% would be interested in using a real-time payment product if their primary bank offered it. For those businesses that stated their interest in using real-time payments, the promise of quicker and guaranteed payments were the most attractive benefits.

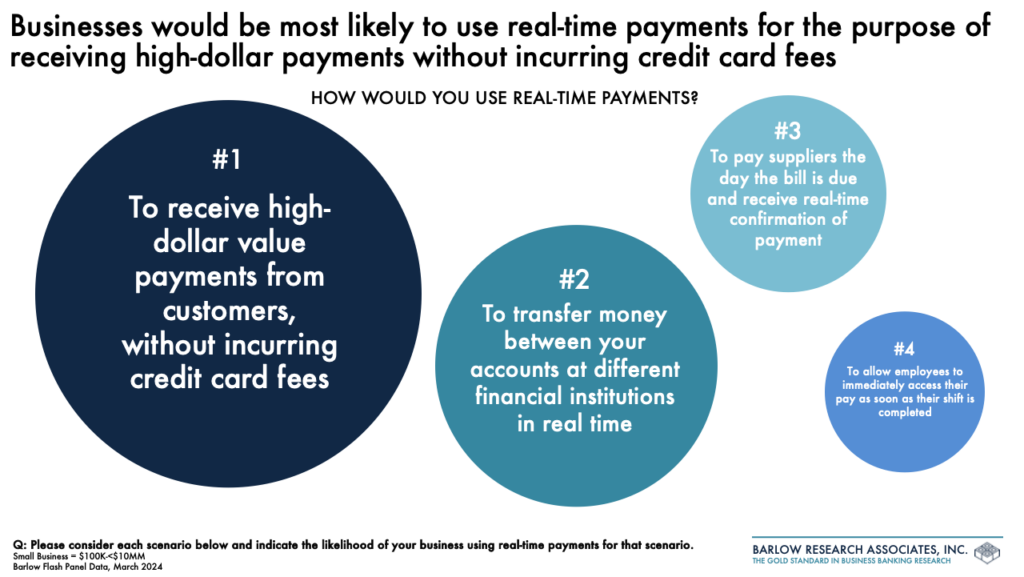

To help identify specific use cases where real-time payments could make sense, Barlow presented four scenarios to small businesses and asked them to indicate their likelihood of using real-time payments in each of these scenarios. As seen below, the most compelling use case among small businesses was to use real-time payments to receive high-dollar value payments from customers without incurring credit card fees, which garnered a 60% very likely to use score. The second most likely scenario was the ability to transfer money between accounts at different financial institutions in real-time with a 50% very likely to use rating among small businesses. The ability to pay suppliers or pay employees in real-time were not as desirable, with only 36% and 17% very likely to use, respectively.

There are significant challenges when it comes to real-time payments for small businesses; the combination of lack of marketing coupled with limited deployment could hamper the real-time payments adoption. While there is much work to be done, Barlow’s data shows that small businesses are interested in real-time payments, and there are use cases where real-time payments are very likely to be used. To drive the adoption of real-time payments among small businesses, it is essential for financial institutions to raise awareness and strategize deployment to avoid cannibalizing or overlapping existing payment methods. The focus should be on specific use cases where small businesses can achieve cost savings, improved efficiencies, and other benefits that can tip the scale to move towards the usage of real-time payments.

For more information about this article, contact Youa Yang: yyang@barlowresearch.com.