Understanding True Middle Market Payment Opportunities in 2024

Susan Nichols

Deluxe

Posted: Aug 8th, 2024

Middle market companies ($5MM-<$500MM in annual sales revenue) and the financial institutions that serve them know how complex and challenging the Accounts Payable (AP) and Accounts Receivable (AR) processes can be. From managing multiple payment methods and platforms, to reconciling invoices with remittance data, to handling manual and paper-based workflows, both AP and AR processing can be a source of inefficiency, cost and potential risk for many businesses.

But there are ways to start optimizing these existing processes today. A recent survey of 793 middle market businesses, sponsored by Deluxe and conducted by Barlow Research, identified some of the challenges and opportunities for middle market companies (and the banks that support them) in both the AP and AR space.

Below are some of the key takeaways from this research that offer the most value and relevance for middle-market companies:

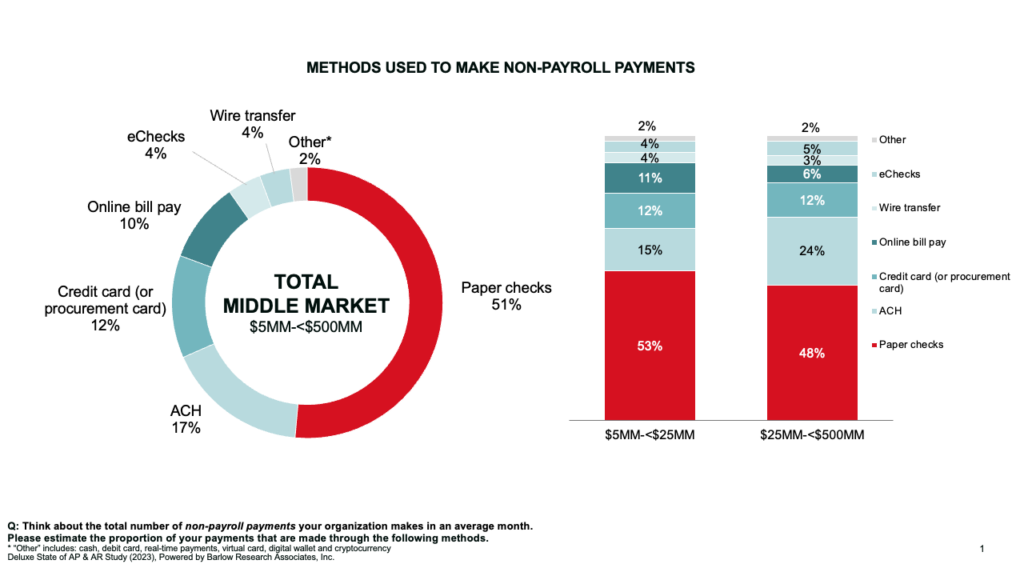

1. Check payments continue to dominate AP and AR.

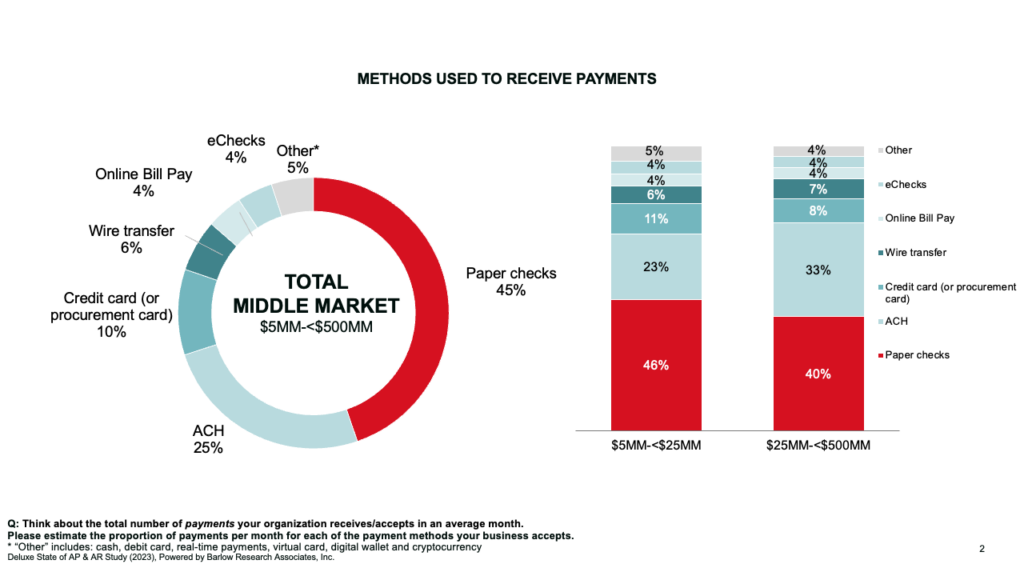

Despite the growing availability of digital payment methods, the study found that 51% of non-payroll payments made by middle market businesses are still done by paper check, and 45% of payments received are also by check. This shows a strong preference for paper checks, regardless of business segment or size, and potentially a lack of awareness or adoption of the benefits of digital payments.

2. Opportunities to digitize both AP and AR processes exist, with more on the receivables side.

The study also highlighted the growing number of opportunities there are for both AP and AR teams to digitize their existing processes. In fact, 47% of invoices received by middle-market companies are paper invoices, while 40% of invoices received are e-invoices sent via email. These paper-based invoices create a lot of manual work for AP teams, who must review, approve and reconcile these payments.

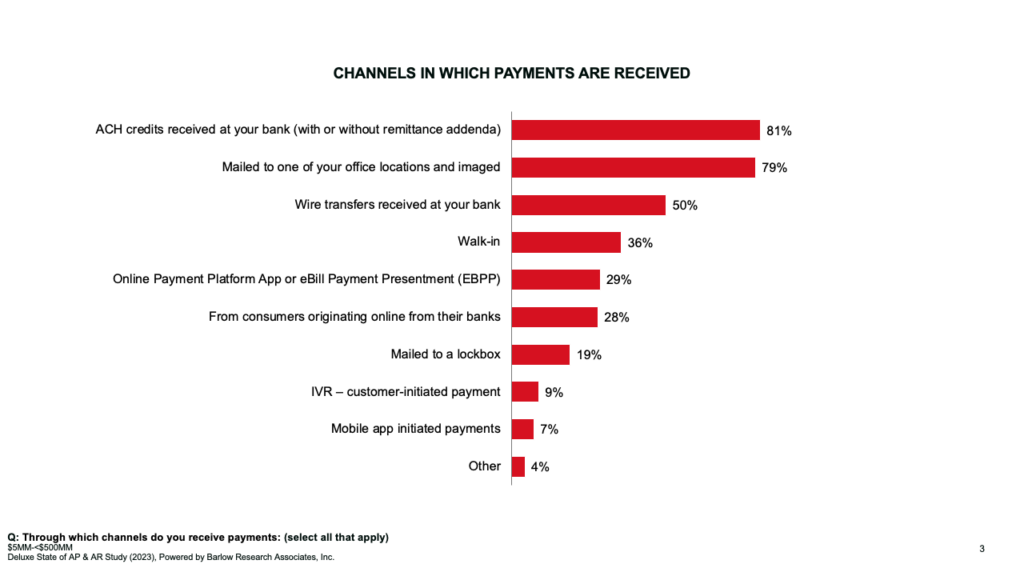

On the accounts receivable side, remittance information is usually included with payments, but the growing myriad of payment channels available for receiving payment has only caused the complexity to grow.

Outside of paper checks, middle-market companies report the following payment methods received:

- ACH (25%)

- Credit or procurement card (10%)

- Wire transfer (6%)

- Online bill pay (4%)

- eChecks (4%)

On average, 41% of payments are received electronically with remittance information included, but the multiple payment channels introduce a whole variety of manual, mixed or automated processing. Our study suggests that middle market AR teams are more ready and willing to digitize invoices to try and solve this complexity, especially when faced with limited resources and staffing.

3. Invoice automation and AI/Machine Learning are the top initiatives planned for AP and AR.

Regardless of size, invoicing automation was picked as the top initiative for both AP and AR teams. One quarter of “order to collect” payment improvement initiatives involve some type of artificial intelligence or machine learning. Some of these initiatives include:

- Billing and invoicing (14%)

- Credit management (10%)

- Automated payment collection (8%)

On the “procure to pay” side, nearly a third of those initiatives involve AI/ML, including:

- Invoice received (14%)

- Payment processing and automation (12%)

- Payment automation (10%)

Among the capabilities to consider, Electronic Bill Presentment & Payment (EBPP) was the top must-have AR capability (28% ranked it as a priority for 2024).

Our research shows that middle market companies are looking for ways to streamline their invoicing workflows, reduce manual tasks and find new ways to leverage data to improve their AP and AR performance in the next 12 months.

These are just three of the highlights from Deluxe’s research, which also examined the impact of different industries, revenues, and customer segments on the AP and AR processes and the best practices and recommendations for bringing more value and insight to the middle market segment.

Interested in learning more about this research? Visit Deluxe to get access to the full report.

About Deluxe:

Deluxe, a modern Payments and Data Company, champions business so communities thrive. With roots tracing back more than 100 years as the original payments company and inventor of the checkbook, we’ve evolved into a leader in digital payments and data solutions, facilitating seamless connections to propel businesses forward. Leveraging our powerful scale, we support millions of small businesses, thousands of vital financial institutions, and hundreds of the world’s leading consumer brands, processing nearly $3 trillion in payment volume annually. Explore how Deluxe can help elevate your business at https://www.deluxe.com/.