Live Chat Is Another Tool in the Digital Solution Arsenal, but It Has Not Been Widely Adopted by Small Businesses

Sandy Hanson

Small Business Program Director

Posted: March 13th, 2024

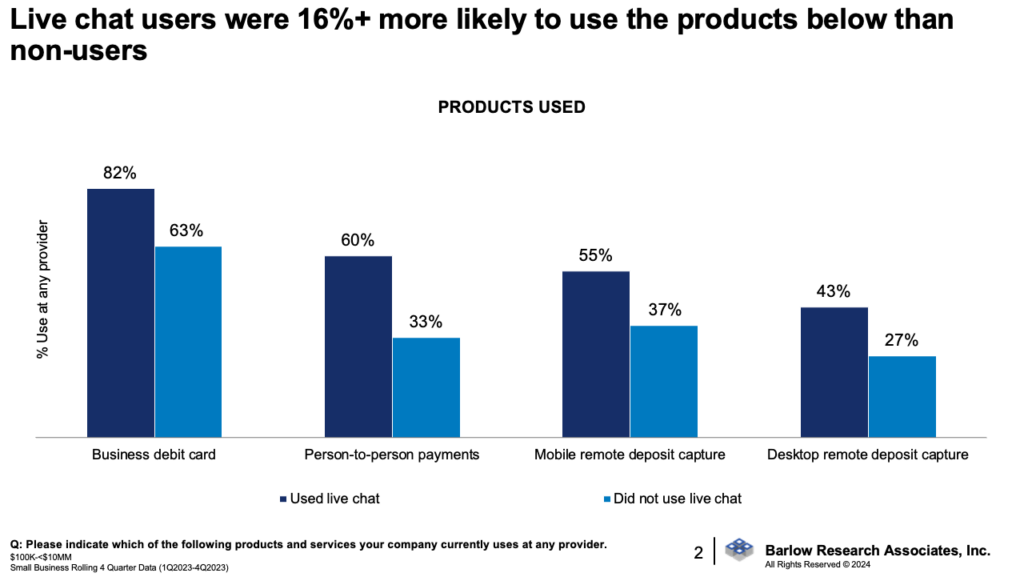

Small businesses ($100K-<$10MM in sales) continue to add to their arsenal of digital solutions to streamline their financial activities. For example, Barlow Research has seen the adoption of mobile banking triple since we started tracking usage in 2013, with 52% of small businesses using the channel today. Additionally, mobile remote deposit capture usage has more than doubled since 2015, with 39% of small businesses using today. Maybe more now than ever, it is important for small businesses to be able to bank when and how they want with access and answers at their fingertips.

One way to provide answers at their fingertips is with live chat channels. While these channels are not new, especially in consumer banking, Barlow Research just started tracking the usage of live chat (via the internet, mobile banking, etc.) among small businesses in 2023. Currently, only 8% of all small businesses indicated that they use live chat at their primary bank. There was no difference in usage by sales size, region of the country or size of primary bank. However, as you may expect, younger owners were more likely to use live chat than older owners. Additionally, diverse-owned businesses were more likely to use than non-diverse-owned and small businesses in the development stage of their business life were more likely to use (see graph below).

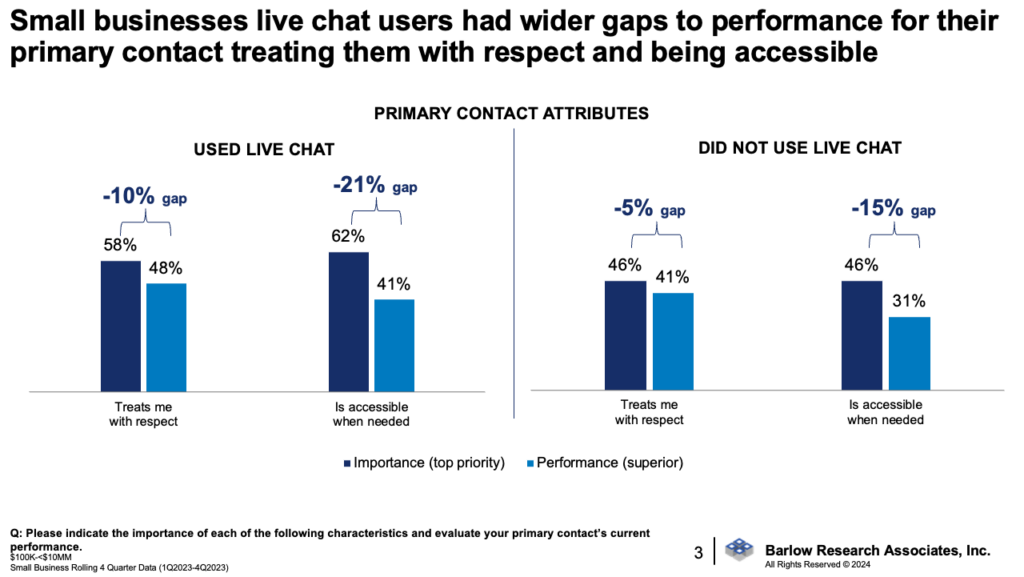

There was no difference in primary contact designation among small businesses based on usage of the live chat channel. Approximately a quarter of each group identified a Senior/Account Officer as their primary contact while the remaining identified someone in the branch as the primary contact. However, there was a difference between users of live chat and non-users in the performance ratings of their primary contact, with live chat users reporting higher performance for all attributes. Live chat users also placed higher importance on each of the primary contact attributes, resulting in larger gaps for the two items shown in the graph below. It could be that some small businesses sought the live chat channel because they felt their primary contact was not as accessible as they wished and/or felt that they weren’t treated with as much respect as they should be. Users of live chat also reported a higher incidence of errors in the last 90 days (17% compared to 11% of non-users) and reported loan response times of nearly two days longer (4.8 days vs. 3.1 days for non-users).

The larger gaps for primary contact accessibility and respect, the higher error incidence and longer loan response times, teamed with the current low adoption rate for live chat, point to a hypothesis that small businesses may view this channel as a last resort to get immediate answers. It appears that when faced with difficulties in reaching a human contact at the bank, these businesses turn to live chat for assistance. Fortunately, despite these challenges, there are no discernible differences in overall bank delight or Net Promoter Scores between users and non-users of live chat. This suggests that, perhaps, live chat serves as a valuable avenue for swift issue resolution, offering timely answers and potentially mitigating any adverse impacts on the overall banking relationship.

For more information about this article, contact Sandy Hanson: shanson@barlowresearch.com

For more information about Barlow Research’s Small Business Banking program, contact: insights@barlowresearch.com