When Small Businesses Receive the Virtual Meetings Desired, Loyalty Improves

Sandy Hanson

Small Business Program Director

Posted: Nov 8th, 2023

Virtual meetings with bankers can offer convenience, flexibility and efficiency for customers while providing cost savings, expanded reach and valuable insights for banks. While virtual meetings are not something that is yet desired by the majority of small businesses ($100K-<$10MM in sales), for those companies that do want them, they can pay dividends to the relationship when they are received.

Barlow Research started tracking the number of actual and preferred virtual meetings scheduled by an Account Officer at the primary bank in 2023. Currently, just 10% of small businesses say they want one or more virtual meetings scheduled per year. However, specific segments are more likely to desire virtual meetings:

- Larger small businesses with $2.5MM-<$10MM in sales were 7% more likely than smaller small businesses to want 1+ virtual meetings.

- Large bank (assets >$50B) customers were 9%+ more likely than customers of medium (assets $1B-$50B) and small (assets <$1B) banks to want 1+ virtual meetings.

- Companies with younger owners (<45) were 6% more likely than those with older owners (65+) to want 1+ virtual meetings.

- Woman-owned (>50%) companies were 5% more likely than non-woman-owned to want 1+ virtual meetings.

- Diverse-owned (>50%) companies were 8% more likely than non-diverse-owned to want 1+ virtual meetings.

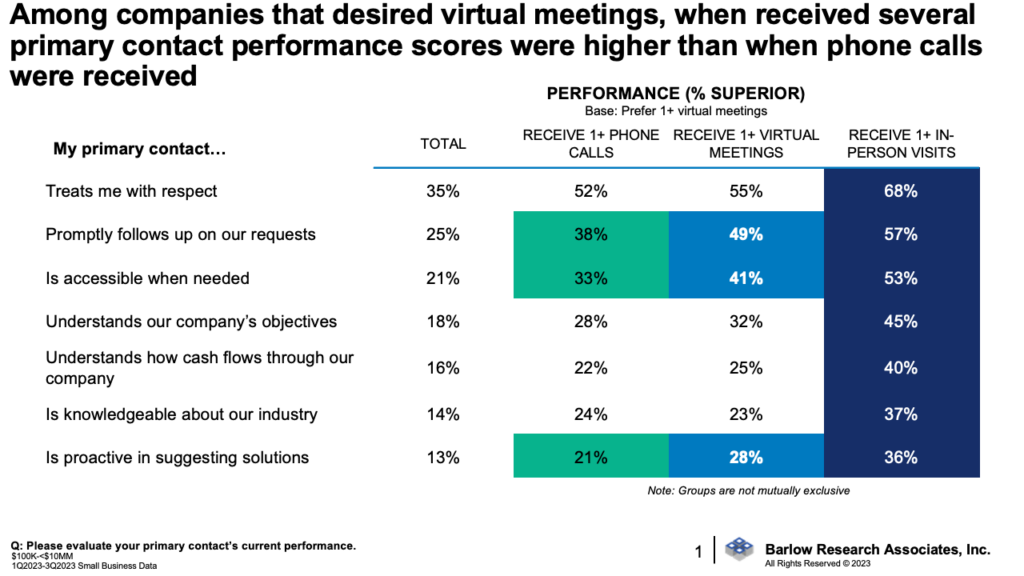

While in-person visits with a banker offer unique benefits that are unlikely to be entirely replaced, for companies that desire virtual meetings, these interactions can strengthen the relationship more than phone calls. As the graph below shows, among small businesses that desired 1+ virtual meetings, if any proactive contact was made (calls, virtual meetings or in-person visits), their primary contact performance scores improved. However, when virtual meetings were received, we saw further improvement in the primary contact performance scores for promptly following up, being accessible when needed and being proactive in suggesting solutions in comparison to the scores on these items when phone calls were received.

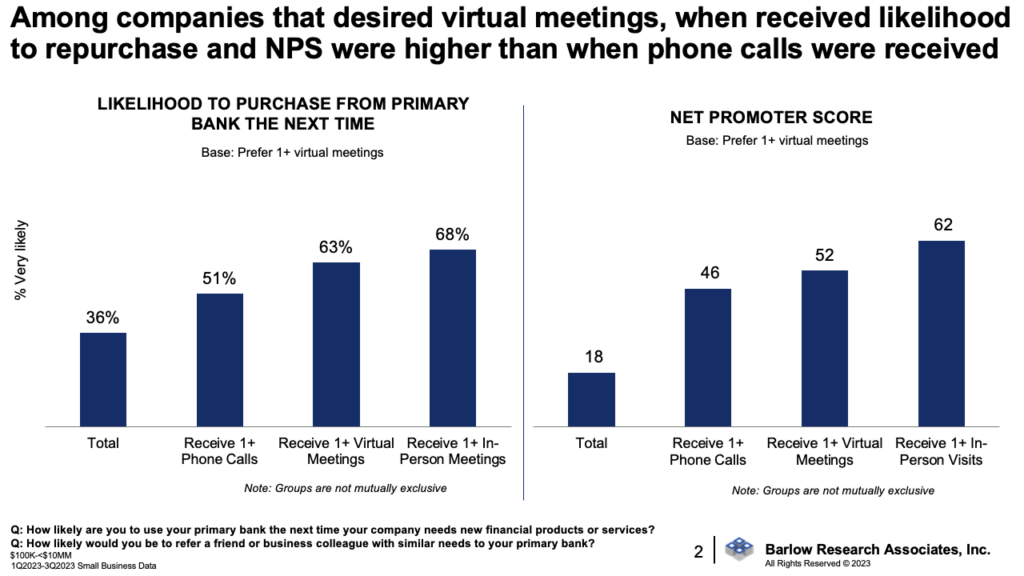

Additionally, we saw a similar lift in scores on two critical metrics, which correlate to new and additional business for the bank. Among companies that desired virtual meetings, just 36% reported being very likely to purchase at the primary bank the next time they had a need. As the graph below shows, that figure increased to 51% among those that received a call but increased further to 63% among those that received a virtual meeting. A similar impact was seen on Net Promoter Score (a referral measure). However, nothing beats receiving an in-person visit, which resulted in the highest scores on both metrics.

While in-person visits may still be essential for certain aspects of the relationship, virtual visits can complement these interactions, providing more frequent and efficient ways for small businesses to engage with their banks/bankers. The key will be to find the right balance between the different types of interactions to meet the specific needs of each small business.

For more information about this article, contact Sandy Hanson: shanson@barlowresearch.com

For more information about Barlow Research’s Small Business Banking program, contact: insights@barlowresearch.com