Navigating Middle Market Credit Demands

Sarah Kietzman

Research Analyst

Posted: May 23th, 2024

Each year, Barlow Research reviews and identifies key drivers of overall bank satisfaction. This year, a new driver of satisfaction emerged from our analysis: My Primary Bank effectively meets our credit needs. According to our most recent Economic Pulse data, credit demand within the middle market segment ($10MM-<$500MM) has returned to pre-Covid levels with just over one-third of businesses either planning to apply for additional credit within the next 12 months, or are unsure about their plans to borrow additional credit. Sixteen percent of middle market businesses were unsure if they would borrow within the next 12 months, an increase of 5% from 4Q2023, likely in anticipation of lower rates. Understanding the specific types of credit sought by middle market businesses, as well as their current pain points, can enable financial institutions to better tailor their offerings and better prepare when credit demand start to rebound.

Types of credit

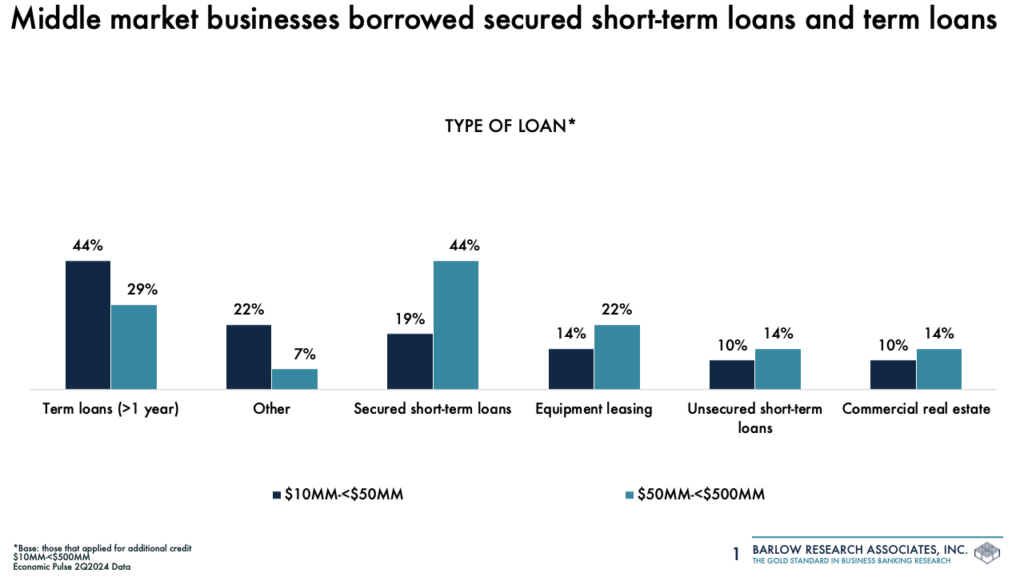

Among those who have applied for additional credit, term loans and secured short-term loans were the primary types of credit middle market businesses were attempting to acquire. Borrowers typically cited working capital or equipment purchases as the purpose for these loans.

Credit pain points

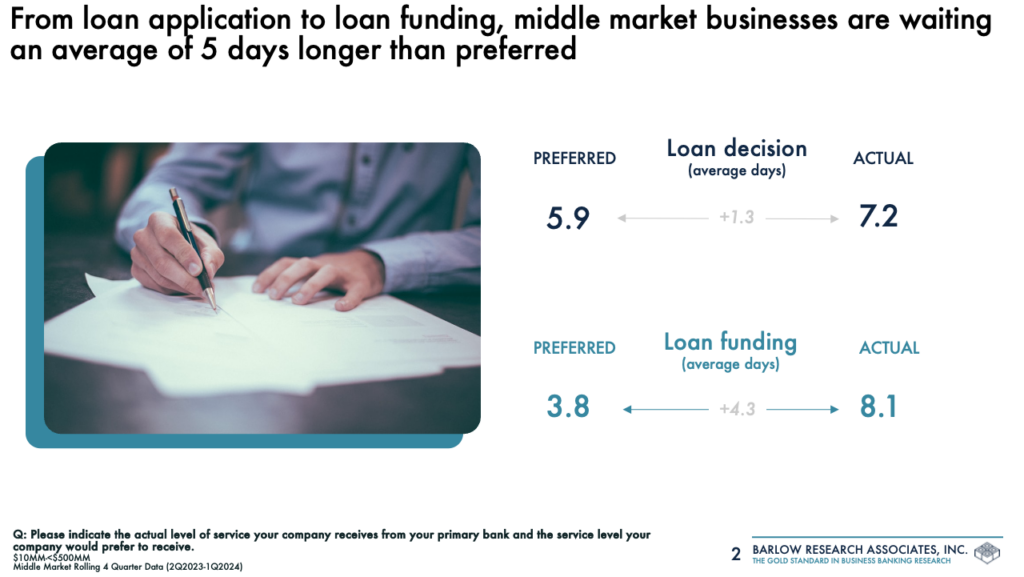

A common complaint within the middle market segment is that the credit process is complicated and slow, summed up by one business, “Our primary bank is a non-commercial bank lender. Their rates are more expensive than a commercial bank. The trade off is they are more responsive and flexible than a commercial bank. Our experience is the commercial banks hide behind credit committees and take a long time to make decisions. [Financial provider] reacts more quickly. I’m willing to pay a premium rate to get a lender who reacts quickly to take care of an unexpected need.” On average, middle market businesses wait one day longer than they would prefer for a loan decision; however, they wait an average of four days longer than preferred for loan disbursement.

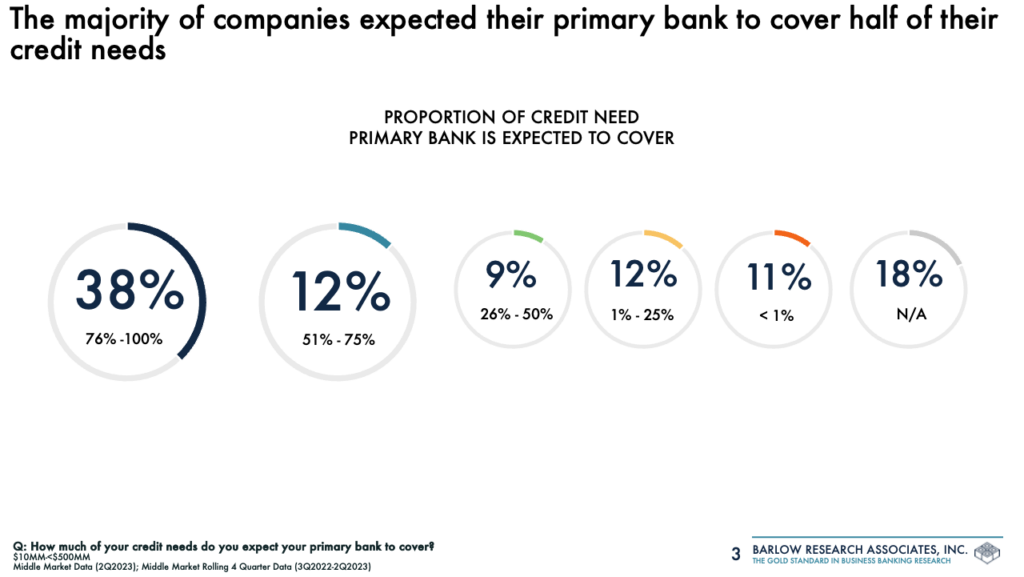

Businesses that are applying for additional credit often go outside their primary bank to secure a line of credit. Of the 11% of middle market businesses that have added a new financial provider, 1 in 4 added for access to credit. Seventy-three percent of middle market businesses use credit, however, half utilize just their primary bank for their credit needs. Large banks (>$50B in assets) have the lowest percentage of middle market customers that use credit with their primary bank, at only at 41%. Further, a mere 28% of businesses strongly agree that their primary bank has an efficient loan application process. Nevertheless, 38% of businesses expect their primary bank to cover at least 76-100% of their credit needs. When a financial institution can meet this demand, they enjoy higher bank delight with 84% stating they are very satisfied with their primary bank; much higher in comparison to the market average of 62%.

Credit demand has stabilized in the middle market. Financial institutions that are poised to meet customer expectations will be best poised to retain middle market customers and increase their bank delight as well.

For more information about this article, contact Sarah Kietzman: skietzman@barlowresearch.com

For more information about Barlow Research’s Middle Market Banking program, contact: insights@barlowresearch.com