How Banks Can Strengthen Their Relationships with Women-Owned Businesses In the Middle Market

Megan Seitchik

Middle Market Program Director

Posted: Nov 1st, 2023

The business landscape is evolving, and women-owned businesses are at the forefront of this change. According to a National Women’s Business Council report, the number of women-owned firms in the middle market ($10MM-<$500MM in annual sales) increased by 89% between 2007 and 2019 (latest data available). Given the significant strides women entrepreneurs are making in the middle market, it begs the question – are Commercial banks meeting their expectations?

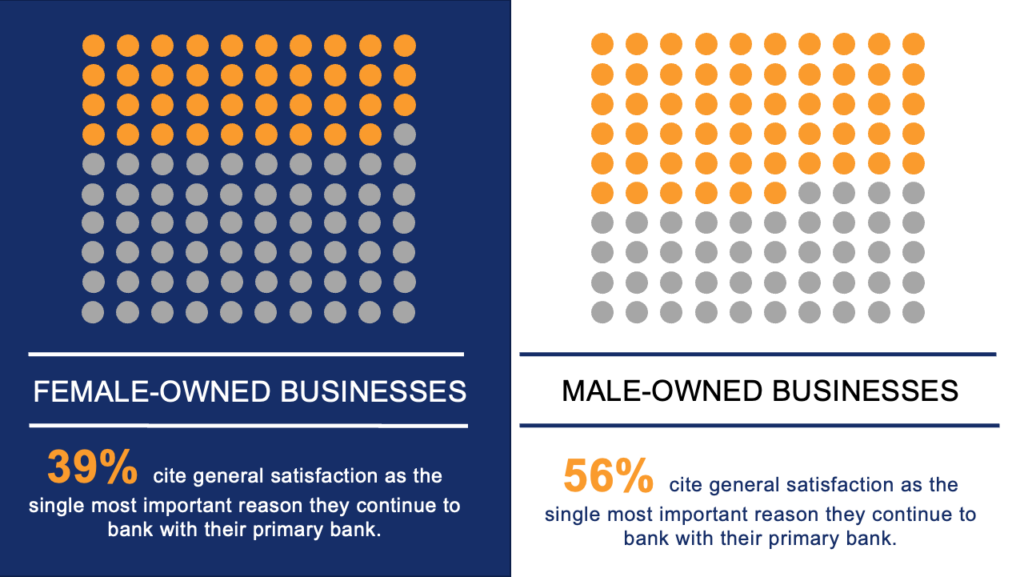

There is minimal variation between female and male owners on many firmographics such as years in business (48 vs. 50 years, respectively) and owner age (65) as well as on some loyalty metrics such as overall bank satisfaction, Account Officer satisfaction and intentions to change primary bank providers. However, stark differences emerge between women and men-owned businesses on other loyalty metrics such as Net Promoter Score (NPS) (35 vs. 47, respectively) and likelihood to repurchase (82% vs. 87%, respectively). In addition, women-owned organizations were much less likely to cite general satisfaction as the single most important reason they continue to bank with their primary bank (39% vs. 56%, respectively) and were more inclined to stay with their primary bank because it would be too difficult to switch banks (16% vs. 7%, respectively) (see chart below).

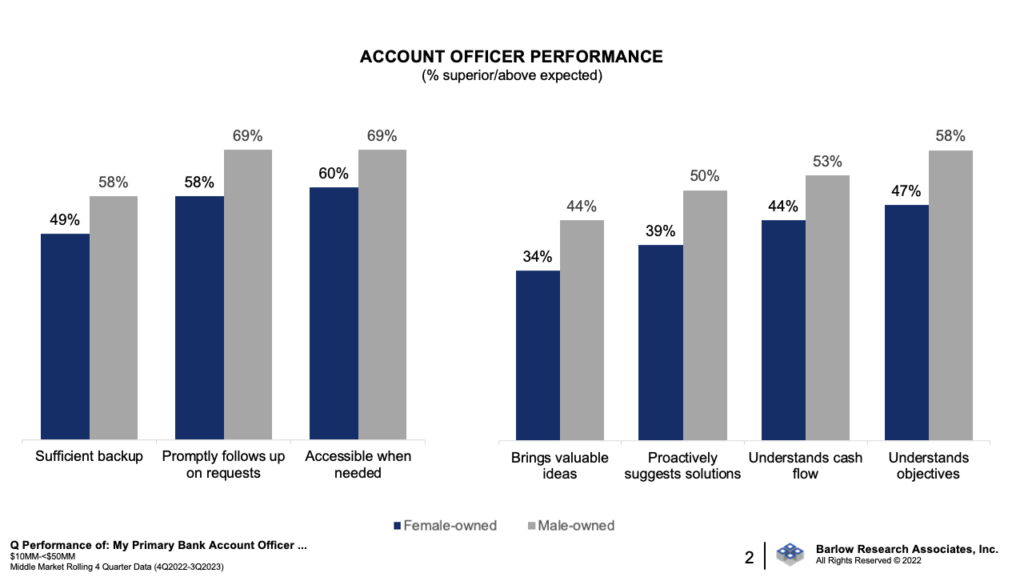

What is driving the mild disenfranchisement of women-owners with their primary bank? The answer may be as simple as responsiveness. Female business owners are less likely than male business owners to describe their primary bank as responsive to their questions and requests (61% vs. 68% strongly agree, respectively). This perception extends to their Account Officers. Female-owned enterprises rate the performance of their Account Officer 9+ ppts lower on promptly following on requests, being accessible when needed and having sufficient back-up in place when their Account Officer is unavailable. A lack of responsiveness and accessibility then feeds into perceptions of a banker’s ability to be considered a true partner or a trusted advisor. A similar pattern is revealed on performance ratings for bringing valuable ideas to help them more effectively run the company, proactively suggesting solutions to financial service needs, understanding how cash flows through their company and understanding their company’s objectives, all attributes with a 9+ ppt gap between ratings provided by women-owned businesses and men-owned businesses (see chart below).

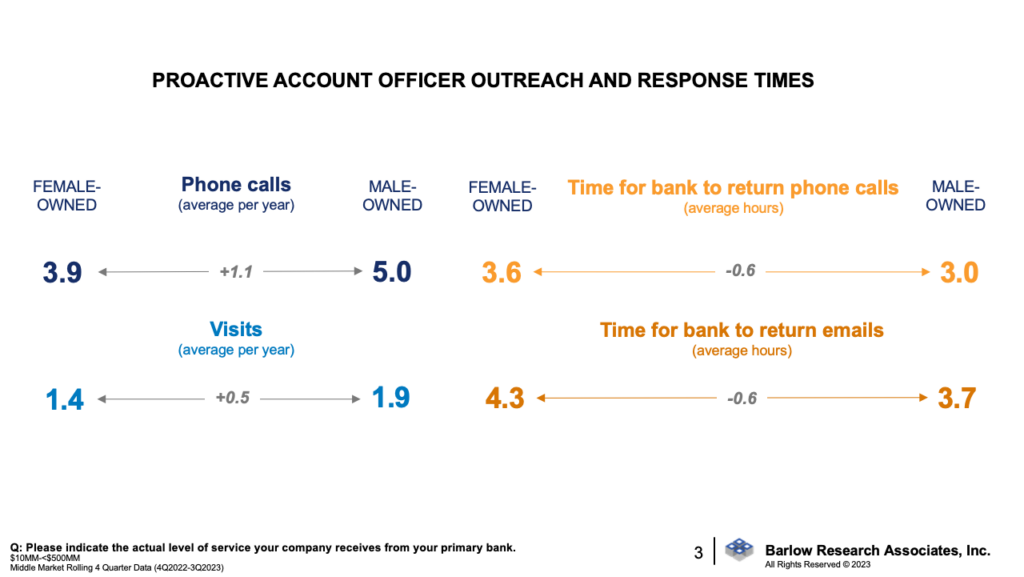

In order to understand why female entrepreneurs would perceive their bank and banker to be less responsive to their questions and requests and less attentive to their relationship one only needs to look at the amount of contact women-owned businesses have with their Relationship Manager and the actual service levels they receive. In the past 12 months, 91% of male-owned companies have used their Account Officer compared to 84% of female-owned companies. Average monthly contacts with their Relationship Manager are also lower for women-owned businesses. In terms of proactive outreach, women-owned enterprises receive fewer phone calls and in-person visits from their bankers. Turning to response times, bankers take longer to return phone calls and emails from companies owned by females (see chart below).

Responsiveness and attentiveness are critical to establishing a strong relationship with clients, regardless of the gender of the business owner. While service-related breakdowns are the primary reason cited for switching primary banks, the nuances differ between female-owned and male-owned companies. Women-owned concerns are twice as likely to name personal attention and responsiveness as the motivator for changing primary banks than male-owned outfits (28% vs. 14%, respectively) and are almost three times as likely to mention a poor relationship with their banker as a reason for adding a new financial provider (11% vs. 4%, respectively).

Key Take-aways

- Women-owned businesses are less likely to cite being generally satisfied as the most important reason they continue to do business with their primary bank.

- Account Officers place fewer phone calls and make fewer in-person visits to female-owned businesses and response times to their phone calls and emails are longer, on average.

- A lack of personal attention and responsiveness is the number one reason women-owned companies change primary banks.

For more information about this article or the Middle Market Banking program, email Megan Seitchik: mseitchik@barlowresearch.com.