Digital Business Account Opening Workflows: Competitive Edge or Mandatory in 2024?

Adam Johnson

CX Research Manager

Posted: Jan 31st, 2024

In the current business banking environment, most leading financial institutions are firmly focused on digital transformations in several areas, expanding or refining digital banking capabilities to meet customers’ needs in new ways. One specific area that has continued to stand out as a priority among several leading institutions is digitizing the account opening process for small businesses. While digital account opening workflows have existed in some capacity for several years, the evolution from a traditional in-branch experience to a seamless, fully digital one has changed how small businesses interact with financial institutions.

Technological advancements in the deposit account opening process have reduced or eliminated the need for paperwork submission and long review periods, enabling the bank to offer decisions very quickly. Making this process as easy and streamlined as possible for the small business customer carries added importance in today’s environment; as many businesses remain interested in adding new deposit relationships to take advantage of high interest rates, financial institutions that can guide new customers in the door efficiently hold the advantage.

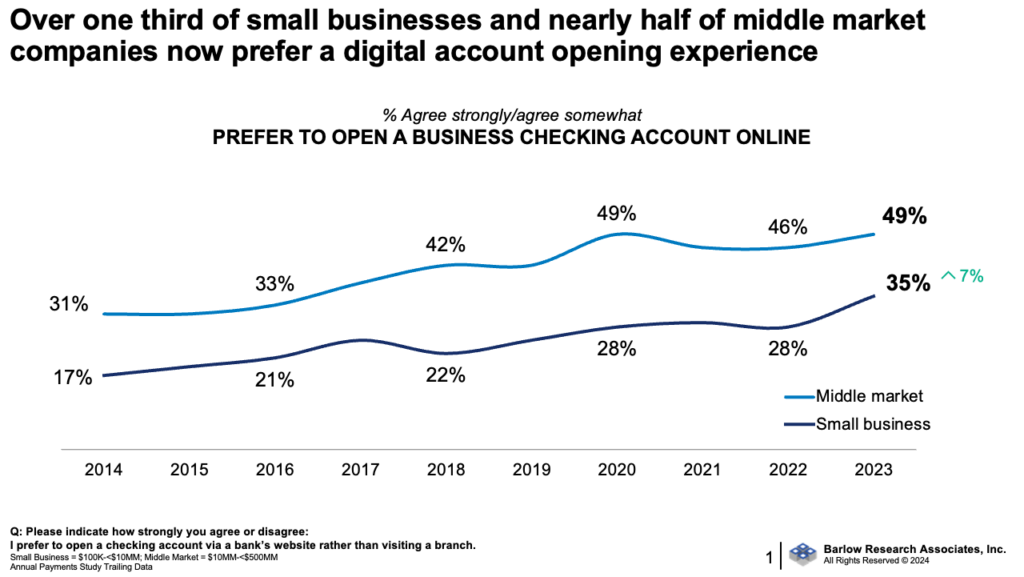

At the same time, there are important challenges to consider. One such challenge is whether business owners and decision makers are willing to open new accounts via digital channels. For nearly 10 years, Barlow’s Digital Business Banking team has been tracking attitudes around digital business account opening capabilities. According to our most recent data, the portion of small businesses ($100K-<$10MM) that would prefer to open a checking account using a bank’s website rather than visiting a branch has reached a new high of 35%, increasing by seven percent from the previous year (see chart below). This percentage has increased slowly-but-incrementally over the last several years, among small businesses and middle market companies as well.

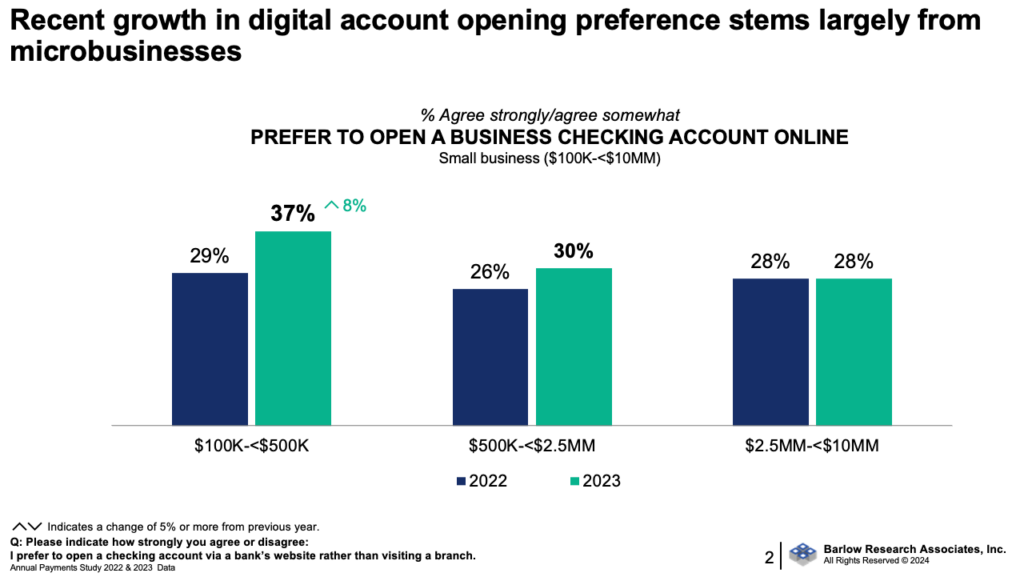

Digging into this data a bit further, we see notable differences within more specific sales cuts in the small business segment. More specifically, we see this increase in preference for a digital account opening experience skews toward the smaller end of the segment. Among those with $100K-<$500K in annual sales, digital preference increased from 29% to 37%; an increase of eight percent from the previous year. Gains were less notable when we look to slightly larger businesses with $500K-<$2.5MM in annual sales, where preference for opening an account digitally increased by only four percent, from 26% to 30%. Further, there was virtually no gain in digital preference among those with $2.5MM-<$10MM in annual sales, which remained steady at 28% (see chart below).

In short, this data highlights the need for institutions to continue their push for advancements to the digital account opening workflow. In order to maximize their efforts to gain new customer relationships moving forward, financial institutions must make it easier and more efficient to open an account online than it is by visiting a branch.

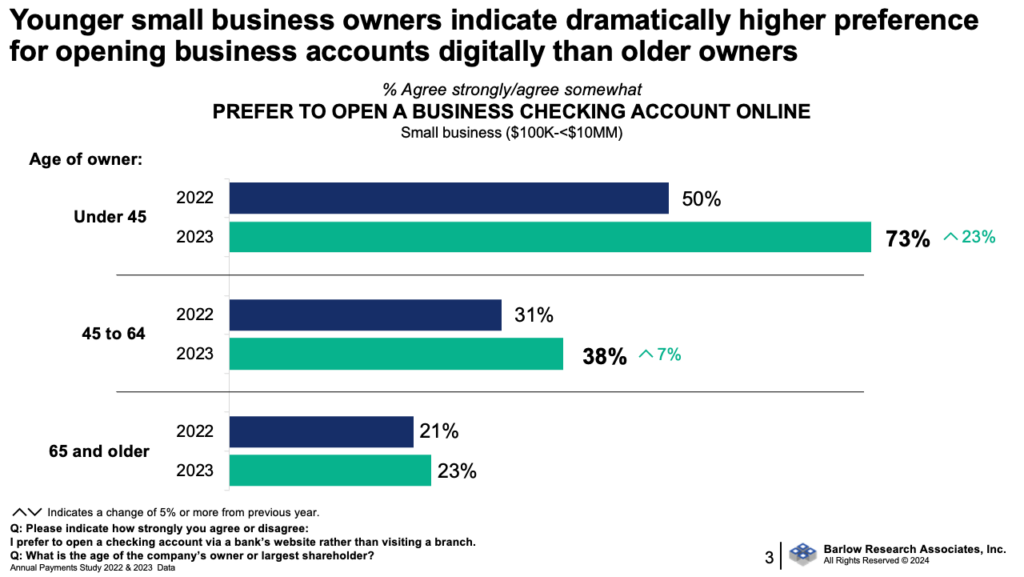

While most small businesses do not prefer a digital experience today, looking at this data across owner age groups offers a look to the near future. Among small businesses with an owner/largest shareholder 65 years or older, fewer than one-quarter would prefer to open account digitally rather than visit a branch (see chart below). However, we see a very different dynamic among the younger generations of owners. Preference for a digital account opening experience increased from 31% to 38% among small business owners between the ages of 45 and 64. Even more notably, this digital preference dramatically increased from 50% to 73% among owners under 45 years old.

While this age group accounts for a relatively small percentage of all owners today, the next few years will see this more digitally savvy generation coming of age. Financial institutions must succeed in delivering a quick, easy and completely digitized account opening experience to hold their competitive footing going forward.

Barlow Research will soon be kicking off the 2024 Digital Account Opening Study. This CX-focused study will provide a first-hand look at the digital account opening workflows for net-new small business customers offered by several leading financial institutions, as well as expert analysis and best practice commentary.

For more information about the 2024 Digital Account Opening Study, please contact Andrea Moore, amoore@barlowresearch.com.

For information about this article, please contact Adam Johnson, ajohnson@barlowresearch.com.