Businesses Aren’t Sold on Digital Cashflow Tools, at Least Not Yet

Julianna Kolb

Research Analyst

Posted: Dec 14th, 2023

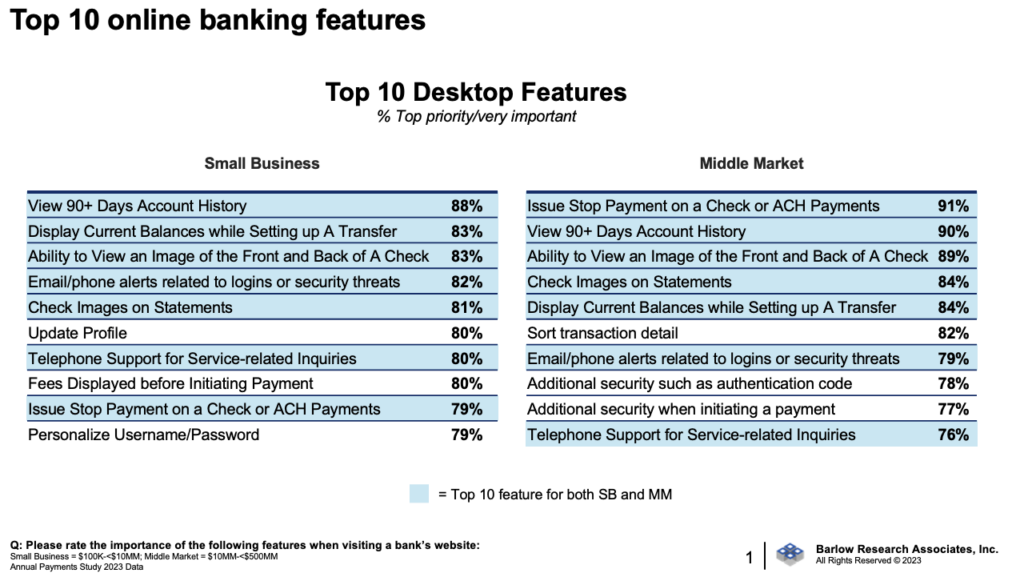

Annually, the release of Barlow Research’s Digital Business Banking Data prompts a critical examination of the pivotal question: Which digital banking features are deemed most crucial for businesses, and which have yet to gain traction? The analysis of these features provides insights into customer values, and often reshapes our understanding of businesses’ digital priorities. Frequently, a disparity emerges between the features that financial institutions prioritize and those that resonate with actual customers. This year’s findings underscore fundamental attributes, primarily centered around account management, safety, and security, with small and middle market businesses expressing a shared emphasis on these aspects.

Conversely, an examination of the features with the lowest importance ratings reveals a distinct lack of enthusiasm for cash flow-related tools. Notably, none of the cash flow features garnered a priority ranking above 40% for either small or middle-market businesses across various industries. This tepid interest is particularly pronounced among middle-market customers; the only feature that ranks lower is the ability to send or request money via Zelle.

The feature importance ratings for the cashflow tools were as follows (by % Top priority/very important):

- Ability to automatically track spending by category

- Small Business: 36%

- Middle Market: 29%

- Ability to create and manage a budget

- Small Business: 27%

- Middle Market: 18%

- Ability to set up a savings goal with automatic savings contributions

- Small Business: 21%

- Middle Market: 13%

- Personalized insights/recommendations to optimize cash flow

- Small Business: 24%

- Middle Market: 17%

- Ability to view at least one month of future account balance and cash flow forecasts

- Small Business: 26%

- Middle Market: 20%

Several factors may contribute to this disinterest. Firstly, businesses, regardless of size, often employ alternative methods, such as Quickbooks platforms and ERP systems, for their financial tracking. Such methods render externally provided cash flow tools redundant for a significant portion of businesses. (51% of small businesses use Quickbooks, Quicken, or other Intuit financial software to arrange their company’s financial statements.)

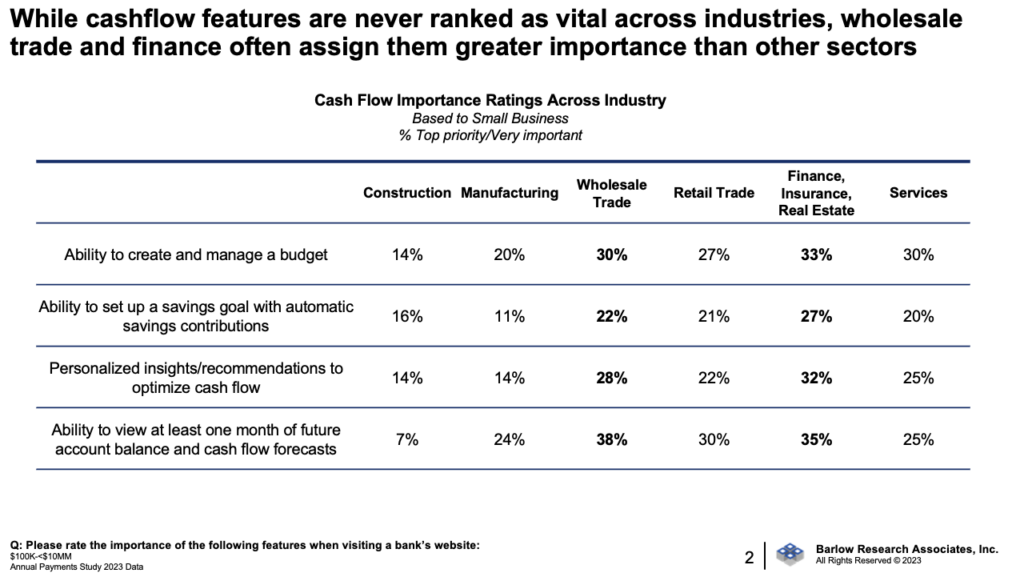

Secondly, the relevance of cash flow tools may vary across industries. Some industries, for example, may find cash flow forecasting less accurate because their cash flow cycles are seasonal or do not behave with a clear pattern. To explore this, we divided the feature importance ratings by the top six most popular industries. We found that – even though the features are still relatively unimportant compared to all other features, Wholesale Trade and Finance/Insurance/Real Estate consistently rated these features higher than other sectors. This divergence suggests that certain industries find the ability to create budgets, receive personalized insights, and view cash flow forecasts more pertinent to their operational nuances.

It should be noted that new features often rank relatively low in feature importance ratings for the first few years, as customers slowly gain awareness of the tools. However, this does not negate the fact that financial institutions must recognize three major factors when developing their cash flow tools:

- A significant proportion of businesses already have cash flow capabilities through other non-bank institutions. Banks must demonstrate how their tools’ utility is greater than ones offered by applications like Quickbooks.

- Some industries are better suited for the use of cash flow tools than others. Institutions must consider industry-specific tailoring of these tools, acknowledging the varied relevance across sectors.

- The fundamental features still rank supreme. Financial institutions must solidify those building blocks before offering extraneous tools such as personalized insights.

Institutions must balance innovation with educating and onboarding their new functionalities, to make sure not only that the tools are well-made, but also that they are being used.

For information about this article, please contact Julianna Kolb, at jkolb@barlowresearch.com.

For more information about Barlow Research’s Digital Business Banking Program or the Test Drive, contact insights@barlowresearch.com.