Early Small Business Optimism Cools, but Middle Market Companies Poised for Growth

Joel Mueller

Managing Partner and the Research Director

Posted: Feb 6th, 2025

Barlow Research continuously tracks the financial health and sentiment of small businesses ($100K–<$10MM in annual sales) and middle market companies ($10MM–<$500MM in annual sales). Our most recent studies after the 2024 Presidential election illustrate how quickly business sentiment can shift. In mid-November, following the election and a Federal Reserve rate reduction, our Business Sentiment Tracking Study revealed a surge in optimism among both small businesses and middle market companies. Many business owners felt more confident about their financial positions and the broader U.S. economy. At the same time, concerns about the high cost of doing business persisted, but only a fraction anticipated declining demand for their products and services.

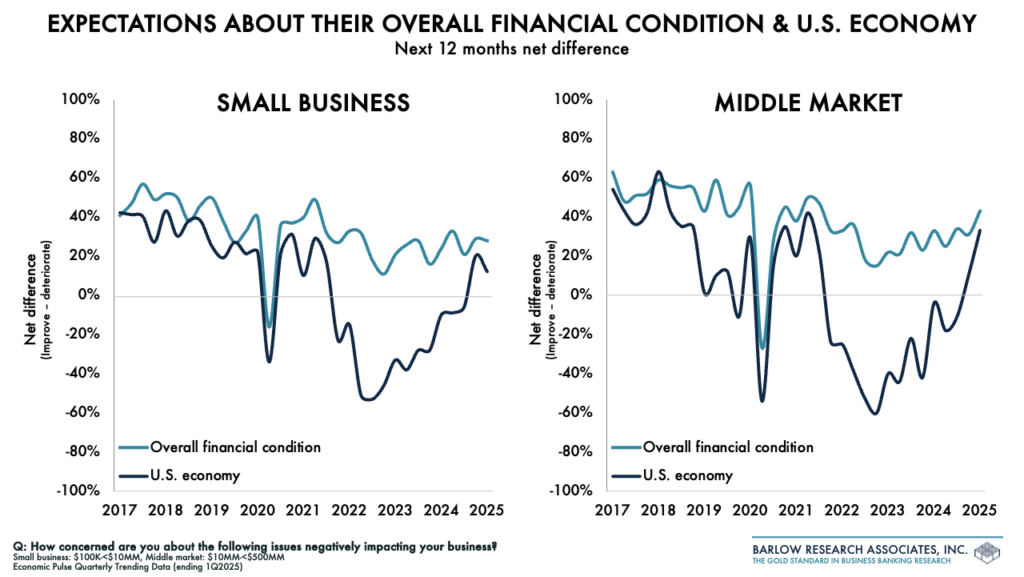

However, just six weeks later, optimism among small businesses had begun to fade. Barlow Research’s Q1 2025 Economic Pulse Study, conducted in early January, found that businesses were still grappling with the challenges of 2024 and had become slightly less optimistic about the year ahead. When reflecting on the past year, both small businesses and middle market companies reported ongoing financial strain. Among small businesses, 33% said their financial condition had worsened, compared to only 17% reporting improvement, marking the sixth consecutive quarter of negative net difference (net difference = the percentage with deteriorating financial conditions subtracted from those with improved financial conditions). Middle market companies fared moderately better, though their financial conditions have steadily declined for four consecutive quarters.

The higher cost of doing business coupled with sales that have yet to rebound to high points last seen in early 2022 have eaten into profit margins. Nearly half of small businesses saw their profits decline over the past 12 months, while only 17% reported an increase. Middle market companies faced similar pressures, with 35% experiencing decreased profits, compared to 29% that saw growth.

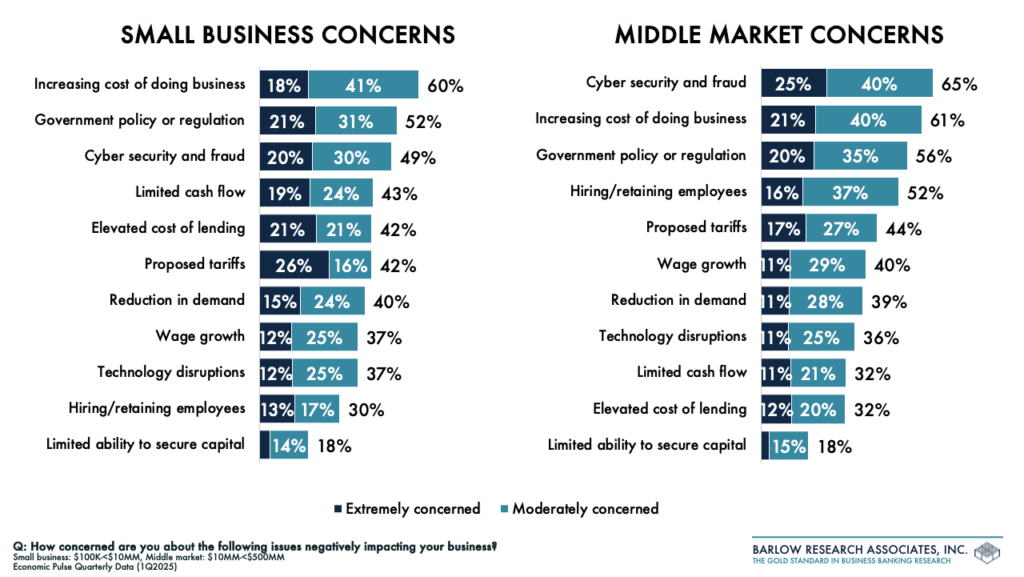

The rising cost of operations remains a significant concern across both business segments. Most small businesses and middle market companies reported that the increasing cost of doing business was either moderately or extremely concerning (shown in the graph below). As a result, many businesses have raised prices to maintain margins, which may have negatively impacted demand. Additionally, proposed tariffs have created further uncertainty, with over a quarter of small businesses and nearly one-fifth of middle market companies expressing extreme concern over potential price increases.

“While our volume is about what it was last year and our customer base has grown, the cost of materials has increased to the point that we either absorb the increases or risk not having the sales we have. Customers will only pay what the value to them is for a product.” ~$100K-<$500K company.

Looking ahead to the next 12 months, both small businesses and middle market companies remain generally optimistic, though their confidence varies (shown in the graph below). Small businesses continue to believe their financial conditions will improve, but they have not seen significant growth in positive expectations for sales, profits, or excess cash reserves. Moreover, their outlook on the U.S. economy has become moderately less optimistic than the post-election confidence spike. That said, economic expectations for 2025 remain stronger than they have been since the third quarter of 2021. In contrast, middle market companies have grown increasingly optimistic across nearly all areas. They are substantially more likely to expect an improvement in both their financial conditions and the broader economy, with increased sales and profit expectations driving much of this confidence.

Demand for additional credit has also seen a slight uptick in early 2025. Seventeen percent of small businesses applied for additional credit in the first quarter, up from a low of 14% in late 2024, while middle market companies saw an increase in credit applications from 27% to 29%. A key distinction between the two segments lies in how they are financing their operations. Small businesses have increasingly relied on personal savings and credit cards in the first quarter of 2025, while middle market companies have turned to commercial banks. Looking forward, businesses in both segments are moderately more likely to seek additional credit over the next 12 months than they were at the end of 2024.

Key takeaways

1. Small business optimism has cooled, but middle market companies remain confident.

Initial post-election optimism among small businesses has declined, whereas middle market firms continue to expect financial and economic improvement.

2. Rising costs and tariffs are concerns.

Increased expenses are pressuring profit margins, forcing many businesses to raise prices, which may be impacting demand. Proposed tariffs add further uncertainty.

3. Additional credit demand has ticked up.

Small businesses are leaning on personal savings and credit cards, while middle market companies are turning to commercial banks for funding.

For more information about this article or the Economic Pulse Study, email Joel Mueller at jmueller@barlowresearch.com.