Leading Your Banking Sales Team: 5 Keys to Success

Enjoy this complimentary article written by our friends at Anthony Cole Training.

Mark Trinkler

CGO of Anthony Cole Training Group

Posted: Jan. 6th, 2025

Barlow Introduction:

Growing your business banking portfolio is a complex but rewarding feat considering the average small business banking relationship is worth more than $9,000 in revenue to your financial institution (according to Barlow Research’s latest voice of the business customer data). Not only is creating a strategy based on Voice of the Customer data and competitive intelligence essential, but arming account officers with the tools to create value and execute that strategy based on that knowledge is a sure way to grow your market share. In our goal to provide additional resources to support the success of your business banking strategy, we share the following article from Anthony Cole Training Group.

The working theory at many banks is that a successful lender or relationship manager can be promoted and successfully transition to managing and coaching others to do the same. However, there are very different skills required of sales managers than salespeople, with the most important of them being the driving desire to develop and achieve success through others. Both roles do include relationship building and the ability to quickly and effectively find and develop a bond with others, however, the core skills of a sales manager must be transitioned from doing to teaching and coaching. Here is a framework of five activities that provide a new or tenured sales leader with specific activities they need to put in place to help them lead their team to greater success.

- Guiding the team to set Extraordinary goals

- Managing excuse making

- Understanding the Will to Sell and Sales DNA factors beneath sales behavior

- Following a coaching process

- Coaching the deal and coaching for skill development

- Guiding the team to set Extraordinary Goals

One of the biggest complaints of many relationship managers is that their goals are set by the company and are not realistic. But interestingly enough, if a sales leader effectively takes their salespeople through a process of establishing their own goals, salespeople will typically set them higher than the company might. We recommend a process to help managers with this problem that includes helping their team establish “Extraordinary” goals. Utilizing a matrix like the one below, a sales manager begins with asking the salesperson what a “Good” goal for their year is and fills that in. Then they decide on “Poor” and “Failing” levels. Once those are established, they have a conversation about what an “Excellent” year would look like, and then what an “Extraordinary” year would be. Numbers are essential along with a discussion of what would be needed to achieve these levels. A good place to start would be to find actionable benchmarking stats to match (or exceed) your customers’ expectations. For example, Barlow Research finds that the average small business prefers their relationship manager to initiate at least one phone call per year. In addition, they expect their phone calls to be returned within two hours and emails to be returned within two and a half hours. Once all those numbers and activities are established, the sales leader asks the lender or RM to which level they want to be managed and coached. Most high-performing RMs will choose the top level. What is key however, is that the sales leader ask the salesperson if they will allow them to be coached to that level and gains the understanding that it will be hard, and challenging. Utilizing this process, the salesperson has established their own goal and will be more committed to doing what it takes to achieve it.

2. Managing excuse making

We all make excuses now and then, however one of the skills of top-performing salespeople is their ability to own their outcomes and results. In our sales management training, we help sales leaders understand the commitment levels of their salespeople and then how to coach to those various levels. We can all recognize there are bankers who will do ‘whatever it takes’, which we call WIT and these bankers rarely if ever, blame the market or the company or anything other than their own actions, for any lack of success. So here is the strategy. When asked ‘Why do you think you did not reach your annual goal, Joe?” and Joe says “Look how many accounts I am managing! How can I do this client servicing work and still bring in new business?” The sales manager replies with “If I did not let you use that excuse Joe, what would you have done differently?” This approach reaps great success because it puts the ball squarely back in the RM’s court and they must think about how they could have adjusted their activities to achieve a different result. They must own it.

3. Understanding the Will to Sell and Sales DNA factors beneath sales behavior

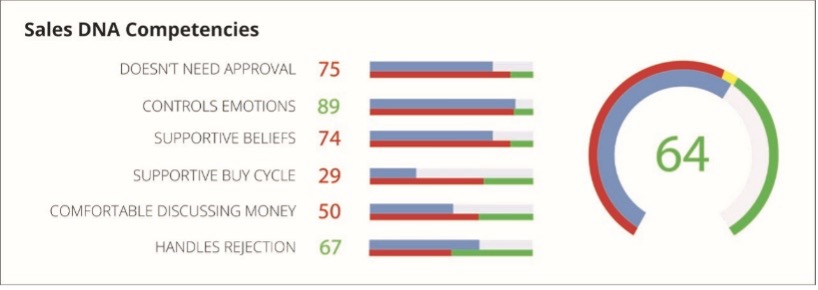

When a banker does not prospect enough or avoids asking about the budget in a sales process or does not ask enough strong qualifying questions, it is often the result of their underlying Will to Sell and Sales DNA. It is impossible to coach these behaviors without understanding what lies beneath the salesperson’s actions. Relationship selling is a complex skill and a sales coach will want to understand these underlying factors about their salespeople to truly coach them to higher levels of performance. For example, if a banker does not feel comfortable that they have the right to ask questions about fees or the rate the prospect is paying (uncomfortable discussing money), they will shy away from doing so. It is easier to teach technique and help them with questions they can be comfortable with once it is understood what is getting in their way.

4. Following a coaching process

Much like mastering a sport like golf and tennis, there are different styles and approaches but there are some technical factors involved in becoming really adept at these sports. Similarly, in our sales management training, we help sales leaders with the technical side of coaching with a 5-step coaching process. Yes, sales leaders must be adept at each of these steps below, but if they simply commit to coaching their salespeople in this manner, they will see a lift.

- Gain insight: find out what is happening or not happening through huddle data or observational coaching, discovery through a coaching session

- Provide feedback: have quality conversations that are timely and specific, asking questions of their salespeople to help them self-discover and gain agreement on the real problem

- Demonstrate and instruct: identify skill gaps, demonstrate mastery of skill and instruct on critical steps to improve

- Role play: complete a pre-call for an upcoming call, RM role plays, complete a post-call debrief together, coach the gaps

- Develop an action plan: determine action steps, observe, inspect and coach again, celebrate results and address failure

5. Coaching the deal and coaching for skill development

Many sales coaches are adept at coaching the deal, helping a lender understand if the prospect fits their target, researching the industry and issues, the complexities of the structure of the deal, etc. However, at a separate time, it is important that sales managers focus on sales behaviors so that they can help a lender make improvements in their strategies, skills, and approach. We recommend establishing coaching hours on the calendar and that is when a salesperson commits to a meeting with their manager, reviews a prospect pre- or post-call and reviews the questions they asked, and completes a qualifying scorecard on the prospect. This is time to sharpen their sword. One of the most important jobs of the sales manager is to practice with their salespeople, take time to help them with a new approach, ask questions in a different way, help them get comfortable with closing questions. This time is set aside, not to focus on a deal, but to improve skills and affect change in behavior and remember, change takes repetition and practice!

Managing and coaching salespeople will always be challenging but it can also have a huge impact on the revenue bottom line, if the leader implements a goal setting process, manages excuses and effectively coaches for skill development. According to Objective Management Group, salespeople reporting to a manager with strong coaching skills tend to have 26% more closeable late-stage opportunities. What bank would not want to add that to their bottom line?

For more insights, view Mark Trinkle’s recap on What Differentiates a Top Banker from a Mediocre One, delivered at Barlow Research’s Business Banking Conference in November 2024:

Watch the Barlow Presentation Summary

Company:

For 31 years, Cole Training Group has been helping community banks close their sales opportunity gap by helping them sell, coach and hire better. Utilizing industry leading sales data and working hand-in-hand with clients, ACTG evaluates the organization, the market, and current individual and company strengths. Our skilled and sales-experienced Sales Development Experts then help to align company strategies and implement a customized Sales Managed Environment® framework that fosters sales growth and production. Our Mission: Grow People, Grow Organizations.