Digitizing KYB Cuts Compliance Costs and Increases Client Satisfaction

William Phelan

Trust2Connect

Posted: Apr 24th, 2025

As digital transformation reshapes banking operations, Know Your Business (KYB) has emerged as one of the most critical and complex areas ready for innovation. KYB underpins essential workflows like account opening, onboarding, and underwriting, where regulatory compliance and operational efficiency must go hand in hand.

KYB verification protects companies from financial crimes and supports regulatory obligations. However, it faces significant challenges: incomplete data, high error rates, process inefficiencies and regulatory complexity. Left unaddressed, these issues can hinder compliance and stall business growth.

From a customer perspective, long cycle times and administrative friction affect satisfaction right at the start of the banking relationship—when experience matters most. I’ve felt this pain personally. It took five weeks to open Trust2Connect’s checking account, delaying our ability to pay suppliers and staff.

The current process is too slow for today’s business environment, which demands near-instant results. Fortunately, recent advances in technology, data, analytics, and AI offer a path forward. This article explores the limitations of current KYB practices, the costs of inaction, and a better way forward through digital innovation.

The Risks and High Costs of Inadequate KYB

KYB exists for a reason: to prevent banks and businesses from inadvertently partnering with entities involved in money laundering, terrorist financing, fraud, sanctions violations, or tax evasion. Shell companies and opaque ownership structures pose real threats. Without effective KYB, organizations may unknowingly facilitate financial crimes or breach anti-money laundering (AML) regulations. The consequences are steep, ranging from legal penalties and reputational damage to lost opportunities and regulatory scrutiny.

Compared to consumer identity verification (KYC), business verification is often more complicated. The vast number of U.S. private enterprises, coupled with fragmented, inconsistent, and non-standardized data, makes it difficult to achieve accurate results at scale.

The cost of getting it wrong—or just doing it the old way—is significant.

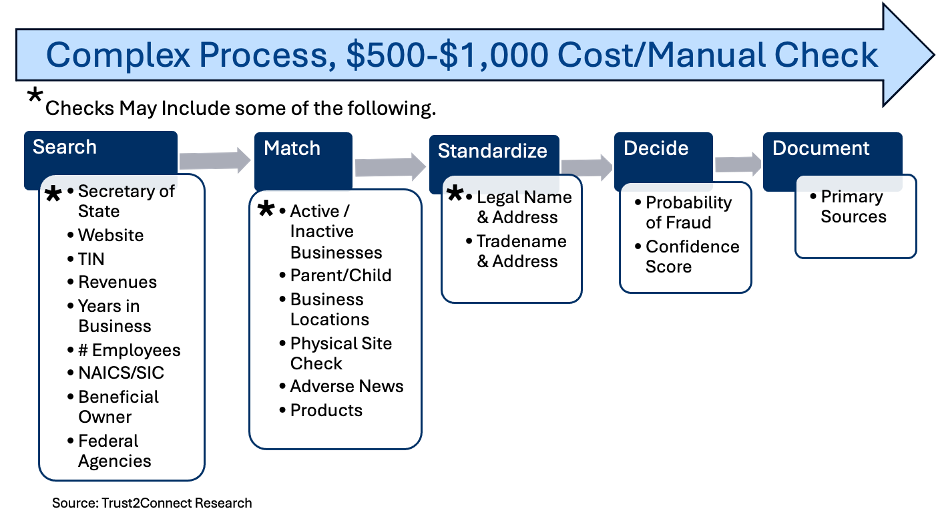

- KYB checks can involve up to 28 steps and cost more than $500 per onboarding

- Annual re-verifications cost an additional $200–$250 per business

- A community bank with 3,000 business customers could spend over $1 million annually on KYB alone

Manual or outdated systems increase risk, drain resources, and slow down growth.

The Solution: Data + AI + Automation = Smart KYB

Modern KYB solutions harness high-quality data and advanced technology to deliver faster, more accurate verification.

- Data platforms curate information on millions of private US businesses from a variety of sources—including government records, business directories, social media and proprietary databases.

- AI-powered keyword parsing and cross-referencing can instantly validate legal business entities and classify industries using NAICS/SIC codes.

- Automated processing can collate all this information and generate detailed reports in seconds.

This approach dramatically reduces KYB cycle time from weeks to hours, enabling real-time decision-making for banks and fin-techs.

The Impact of Digitized KYB

Digitizing KYB has a wide range of benefits:

- Risk & Compliance: Enhances protection, supports agility and simplifies audits

- Cost Efficiency: Cuts verification costs and unlocks real-time monitoring

- Strategic Growth: Frees staff to build relationships, not chase paperwork

- Customer Experience: Speeds onboarding with fewer friction points

Whether you’re opening a new account, onboarding a vendor or verifying a customer, digital KYB provides a seamless, scalable path forward.

Conclusion: KYB Is a Strategic Advantage

Digitized KYB transforms onboarding from a bottleneck to a competitive edge. Banks and fintechs that modernize now will not only reduce exposure to financial crime but also build better, faster relationships with their business customers.

Digital KYB is no longer optional—it’s a strategic imperative.

Learn More

To explore how Trust2Connect can help streamline your KYB process, visit

🔗 www.trust2connect.ai

🎯 Free trial access

For questions or feedback on this article, contact:

📧 Bill Phelan | wphelan@trust2connect.ai

About Trust2Connect

Trust2Connect (T2C) was founded by former Equifax executives to modernize business-to-business verification. Leveraging deep domain expertise in business data, T2C integrates over 100,000 data sources—including government, public, private, and online platforms—to deliver comprehensive, curated business profiles in seconds. Our platform enables banks to conduct thorough KYB checks faster and at a lower cost, helping customers move from application to activation in record time.