Small Business Banking Isn’t One Size Fits All

Posted: Jun 12th, 2025

Small businesses are not just the backbone of the American economy – they are also one of the most dynamic and nuanced customer segments in banking. In a recent episode of Jack Rants with Modern Bankers, host Jack Hubbard welcomed Barlow Research’s own Sandy Hanson, Managing Partner and Small Business Banking Program Director, to spotlight the small business segment in honor of Small Business Month. The episode offered a rare blend of fresh research, frontline insights and actionable advice for banks of all sizes.

Segmenting the Market for Precision Strategy

According to Sandy, Barlow Research’s segmentation of the small business universe is an approach that helps banks target their services more effectively to small businesses.

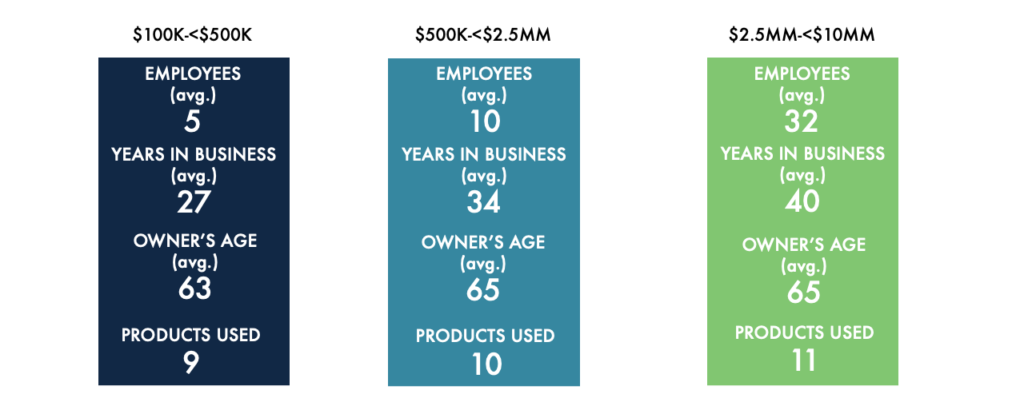

Barlow Research’s small business segmentation:

- Micro Businesses ($100K–<$500K in revenue): Represent 80% of small businesses. They lean on reactive service, as well as branch and digital access.

- Small Enterprises ($500K–<$2.5MM): Embody 15% of small businesses. They use more complex services like payroll and lending, and require more relationship depth.

- Business Banking ($2.5MM–<$10MM): Though only 5% of businesses, they drive revenue and demand proactive service from Relationship Managers.

This segmentation captures how business needs become more complex as companies grow in sales. A strategic, data-informed segmentation framework enables banks to calibrate product offerings, service models, and relationship strategies to the distinct profiles of each small business tier. Differences in behavior, staffing scale, and operational sophistication across segments inform how banks can deploy resources. By aligning banker coverage, digital investments, and product priorities with segment-specific demands, institutions can reduce friction, improve product adoption and strengthen relationships.

Relationships Still Matter… A Lot

While products and digital capabilities are essential, 41% of small businesses value their relationship with their banker as much as the products and services offered. Yet trust is earned. Sandy emphasized the importance of the “ABC’s” for bankers:

- Accessibility: Timely and reliable communication

- Bank Knowledge: Familiarity with internal products, processes and referral pathways

- Customer Understanding: Awareness of goals, operations and industry

These qualities are non-negotiables for becoming a trusted advisor. However, small businesses don’t automatically turn to banks for advice; many go to accountants, attorneys, peers or even Google. For banks to become seen as valued advisors, they must consistently demonstrate their relevance, reliability and knowledge of their customers’ needs.

“It’s really not until you can prove that you know the ABC’s – that you’re accessible, that you know the bank, and that you understand the customer – that a client is going to listen to your suggestions.” — Sandy Hanson, Barlow Research

Room to Grow and Tools to Help

Barlow Research’s data confirms that small business clients typically use between 9 and 11 financial business products, but award only about 80% of them to their primary bank on average. That leaves cross-sell and retention opportunities wide open. Sandy urged bankers to proactively identify product gaps using tools like Barlow Research’s Customer Profiler, which benchmarks typical product usage by industry and size.

Data-driven benchmarking and client perception analysis can further inform strategy. Tools that assess relationship quality, account manager workload, and product penetration across segments offer banks a way to align internal resources with client expectations. When updated consistently and viewed through a segment lens, this type of intelligence becomes critical for reducing attrition risk and enhancing cross-sell performance in a competitive landscape.

“Before you meet with a customer, you have to take some time to sit down and really look at what are they using with us. What do companies like them… in general… what are they using? Is there a gap?” — Sandy Hanson, Barlow Research

The Takeaway

Whether you’re at a large institution, a regional bank, or a credit union, the message is clear: small business customers expect more than transactions. They expect responsiveness, relevance and real relationships.

With nearly 7 million small businesses across the U.S. and an increasingly competitive landscape, there’s never been a better time to realign your strategy around their evolving needs. Tools like Barlow Research’s Syndicated programs can illuminate the path forward – turning insight into impact.

The Modern Banker

Jack Hubbard is Co-Founder and CEO of The Modern Banker and Chairman Emeritus of St. Meyer & Hubbard. The Modern Banker is a training and coaching firm that created LinkedIn Mastery for Bankers. With eLearning, virtual learning and classroom learning options, the program helps bankers connect LinkedIn to their daily sales routines. More than $200 million in new business has been reported from bankers who use the program. LinkedIn Mastery for Bankers is the only bank-specific LinkedIn to Sales training available in the industry.

For 25 years, St. Meyer & Hubbard has provided classroom and virtual training for more than 200,000 bankers and bank sales leaders in 49 states. With 37 bank to business, consumer, call center and mortgage Playbooks, SM&H sets the standard for bank sales training and coaching. In 2025 SM&H launched AI Navigator, which reduces call planning from hours to seconds.

Jack Hubbard can be reached at jhubbard@smandh.com.