Three Things to Know if You’re Seeking Business Deposits

Joel Mueller

Managing Partner and Research Director, Barlow Research

Posted: Jun 19th, 2023

The Fed did not raise interest rates for the first time in over a year in its June 2023 meeting, yet many businesses continue to assess the return they receive on their deposits. Recent bank failures have also catalyzed many companies to evaluate the diversity of their banking relationships. According to Barlow Research’s quarterly Pulse study, nearly half of businesses have re-evaluated where their money is held due to the recent bank failures alone. In addition, 68% of small businesses ($100K-<$10MM in annual sales) and 45% of middle market companies ($10MM-<$500MM in annual sales) do not believe they are receiving a competitive rate on their business savings accounts. It’s easy to understand why our industry has focused on finding and protecting core deposits.

You should know three things if growing business deposits is a priority for your institution.

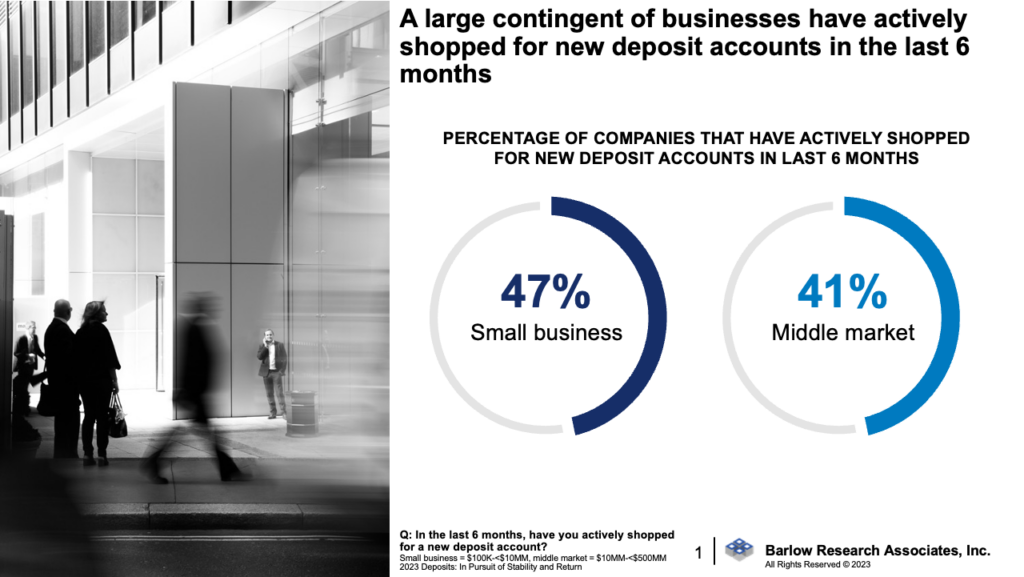

1. Businesses are actively shopping for new accounts.

According to data Barlow Research collected in May 2023, 47% of small businesses and 41% of middle market companies have actively shopped for new deposit accounts over the last six months. Recent concerns over bank stability have influenced much of this shopping behavior. Approximately four in ten businesses indicated that their decision to start looking for a new deposit account was either directly or somewhat related to recent concerns about their bank’s stability.

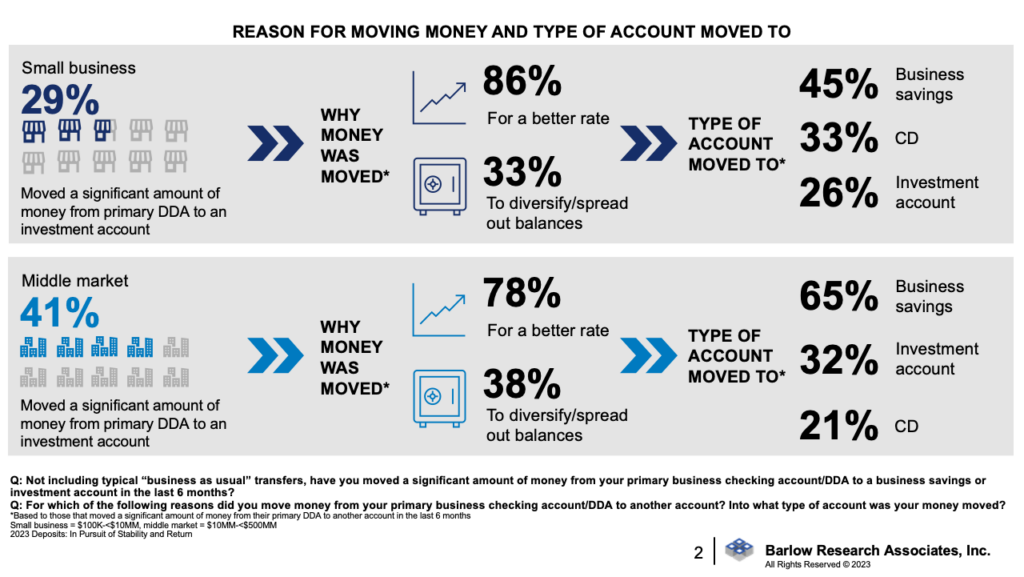

In addition, many businesses (29% of small businesses and 41% of middle market companies) have moved or are moving a significant amount of money, beyond business-as-usual transfers, from their primary DDA to a savings or investment account. Approximately half of the businesses that moved a substantial portion of their deposits from their primary DDA opted to transfer them to a non-primary financial institution. FDIC coverage is a consideration for 55% of small businesses and 49% of middle market companies when deciding how much money to move.

2. Bank stability is important, but competitive rates are essential.

The perception of instability within the banking system may have been enough to push some businesses to begin looking for a new bank, but competitive rates drive companies to move money. Among those that moved capital from their primary DDA in the last six months, 86% of small businesses and 78% of middle market companies did so to take advantage of an attractive interest rate.

So, what constitutes an attractive rate? On average, small businesses will need a 3.2% interest rate, and middle market companies will need a 3.3% interest rate to consider opening a new business savings or money market account. Currently, small businesses receive an average of 1.9% on their business savings accounts, with 47% receiving less than 1.0%. Although middle market companies earn a higher rate, on average, than small businesses (2.6%), a quarter of companies still earn less than 1.0%.

3. A small portion of businesses holds most deposits.

Short-term investment accounts are not mass-market products: 80% of balances are held by only 19% of businesses. The challenge is determining where banks will carve out their niches and what strategies will be implemented to attract new business.

Industry specialization is one of the more common strategies that many financial institutions take to target high-depositing segments in the business market. And for good reason. There are large disparities in average balances across various industries. If you follow this method, playing in the right industries/sectors and appropriately preparing Account Officers for conversations is crucial.

- Know which industries or sectors are a key focus for other institutions. Unless your institution has a key competitive advantage within a given industry, focusing on prospecting in a highly competitive industry may be an uphill battle. Some of the most common industries/sectors that the Top 10 banks focus on are commercial real estate, healthcare, higher education and auto dealerships.

- Prospecting in a given industry requires Account Officers to “speak the language.” Knowing a prospective client’s industry can be highly impactful, especially when building trusted relationships. Barlow Research’s most recent rolling four-quarter data suggests that over two-thirds of small businesses and middle market companies find it a top priority/very important for their Account Officers to be knowledgeable about their industry. However, just over half of Account Officers in both segments exceed expectations in this domain.

Three questions to ask yourself as you build out an approach to win deposits:

- Is your institution perceived as stable?

- Do businesses find the rates you offer to be attractive?

- What is the strength of your bank’s brand (and the strength of relevant competitors)?

The bottom line is that the fight for deposits is far from over, and the institutions equipped with the best insights will have a leg up on the competition. If growing business deposits is a priority for your institution, contact Barlow Research to learn more about our new study, Finding and Protecting Business Deposits. This body of work will be available in July 2023 and provide your institution with unique voice of the customer market intelligence related to churn in the business and commercial banking segments, rate sensitivity and where financial institutions could focus to grow core deposits.

About Joel Mueller and Barlow Research

<div “=””>Joel is a Managing Partner and the Research Director at Barlow Research. He heads up Barlow Research’s proprietary & custom research division and serves as the manager of the analyst team. He is responsible for the strategy, administration, analysis and reporting of various proprietary & custom studies. Joel specializes in both small business and middle market research and has led large-scale research initiatives in small business lending, small office/home office businesses and vertical/industry value proposition analyses.

Find more articles like this, videos and resources HERE.

Contact information: Joel Mueller jmueller@barlowresearch.com , 763-253-1806