AI Fraud — The Threats to Business Banking

Dan Latimore

Posted: Oct 2nd, 2025

I recently reviewed a talk1 on GenAI that I gave at Barlow Research’s conference in the spring of 2023; the evolution of that technology since then has, as predicted, been remarkable. Advances in voice synthesis and image generation have opened new threat vectors that every small business – and bank that serves them – must take seriously.

Sam Altman has warned about the risks of fraud in a very provocative way: “A thing that terrifies me is apparently there are still some financial institutions that will accept the voiceprint as authentication,” Altman said. “That is a crazy thing to still be doing. AI has fully defeated that.”2

And it’s not just voice. In February 2024, a Hong-Kong based finance department employee was tricked into sending $25 million to fraudsters after a video conference with what he thought were other members of staff. It turns out that every participant was a deepfake realistic enough, on both voice and video, to dupe the worker.3

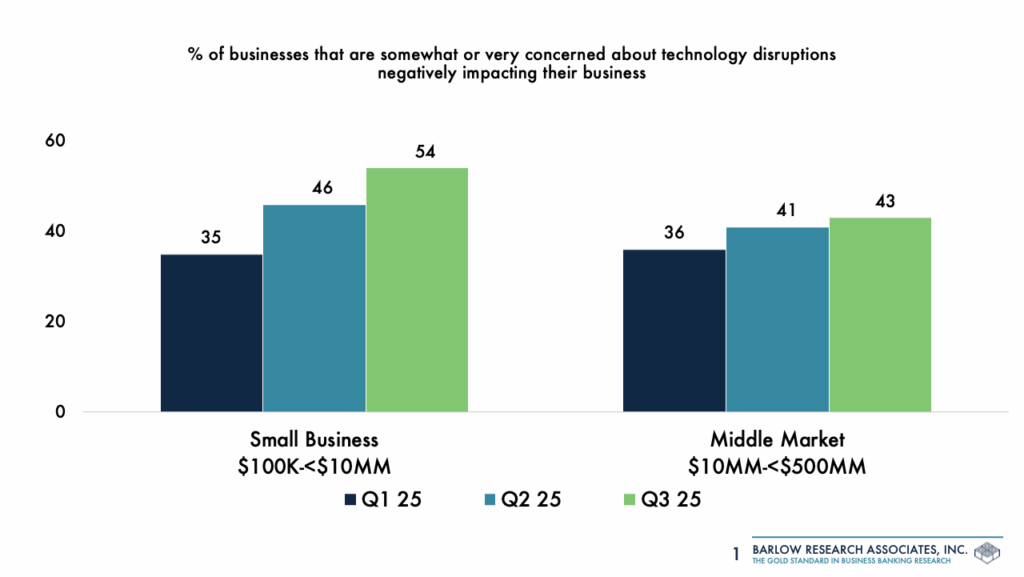

Data collected by Barlow Research shows that small and medium businesses are increasingly worried about this, too, as they should be.

- Educating customers so that they create a culture of care, catching fraud before the bank is ever involved. Institutions like Bank of America and U.S. Bank are now providing gamified security centers to empower businesses to protect themselves by opting into security and fraud features.

- Giving customers a choice as to levels of authentication so that they can decide the appropriate mix of convenience and security at varying limits. For example, digital banking platforms at Chase and Truist have introduced customizable user controls to let business owners manage their team’s account access and require approvals for large payments.

- Reexamining current authentication and fraud detection techniques, like voice authentication, to see whether they’re still effective considering evolving technology. Passkeys superseding passwords is one example, while multi-factor authentication (e.g., one-time passcodes) is moving beyond the login to procedures like initiating ACH payments or updating profile information.

- Using AI to flag suspicious activity through anomaly detection, invoice authentication, and enhanced verification processes. Training AI on historical invoice data can quickly flag duplicate invoices with different numbers, unusual payment terms, or pricing discrepancies.

[1] Generative AI, Chat GPT, & other LLMs: What banks should do today to prepare for tomorrow

[2] Sam Altman says financial industry faces a massive ‘fraud crisis’ as AI impersonates people’s voices to trick security | Fortune

[3] Finance worker pays out $25 million after video call with deepfake ‘chief financial officer’ | CNN

[4] WHITE PAPER- U.S. Fraud Report 2025.pdf from Trustpair.

About Dan Latimore

A seasoned international strategy and research executive, Dan Latimore has been investigating technology and its effects on business since the days of the first financial services websites. A keen student of human psychology and behavioral finance, he connects disparate ideas and perspectives to deliver pragmatic and impactful advice to his clients.

Latimore recognizes that every strategic decision that a financial firm makes has a technology component; too often, though, technology implications aren’t fully considered. He understands the interconnectedness of the financial services ecosystem and the necessity of bringing the human element into strategic decisions.