Fifth Third’s Comerica Acquisition Unseats Top 10 Bank Competitors in Small Business and Middle Market

Sandy Hanson

Posted: Oct 16th, 2025

Fifth Third’s $10.9B acquisition of Comerica, announced on October 6th, will create the 9th largest U.S. bank with approximately $288B in assets and substantially strengthen its footprint in the West and South, adding Arizona, California and Texas to the bank’s footprint, as well as greatly increasing its presence in Michigan. While business banking has become increasingly digitized, the branch remains very important to business customers, especially small businesses ($100K-<$10MM in sales). According to Barlow Research’s 4Q24-3Q25 data, 59% of small businesses indicated a conveniently located branch was top priority when choosing a new primary bank, followed closely by full-featured online banking at 58%.

Change Up in the Competitive Landscape

We may be in another cycle of merger activity, especially with regional banks, due to lighter regulations under the current administration. Earlier this year, we saw several merger announcements, including PNC and FirstBank, Huntington and Veritex, Pinnacle and Synovus, in addition to several others among medium (assets $1B-$50B) and small (assets <$1B) banks.

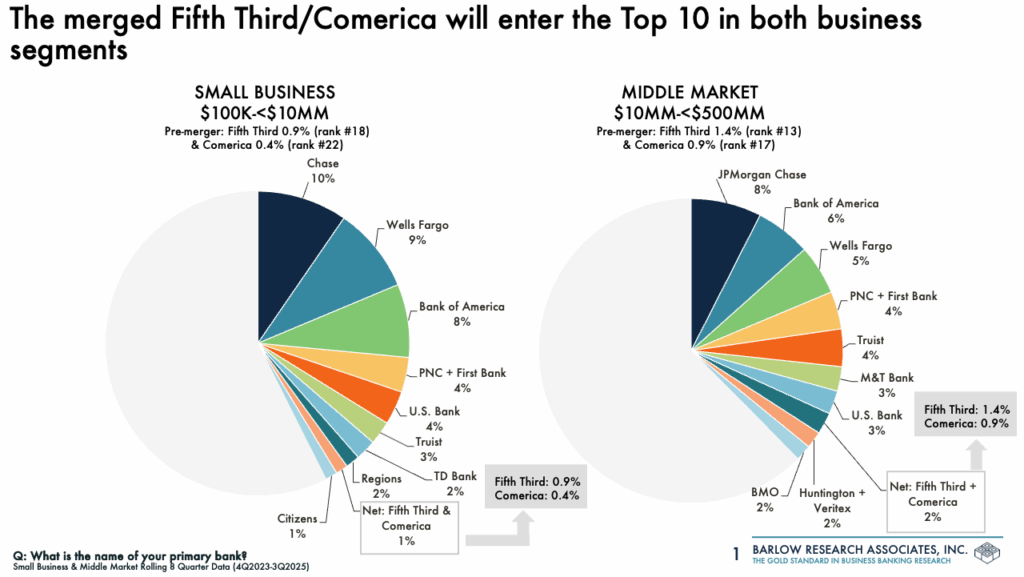

Nationally, the combination of Fifth Third and Comerica catapults the merged institution into the Top 10 in primary bank market share in both small business and middle market ($10MM-<$500MM in sales), as shown in the graph below. According to Barlow Research’s most recent rolling eight quarter (4Q23-3Q25) data, the merged institution will rank ninth in small business, displacing Huntington from the Top 10, regardless of their merger with Veritex. In middle market, we will see an even larger shakeup. In addition to Fifth Third moving into eighth place, BMO will join the Top 10 ranks as well. This movement will displace two banks out of the Top 10 – TD Bank and First Citizens. Note that the combined market share figures assume that clients do not defect due to the merger.

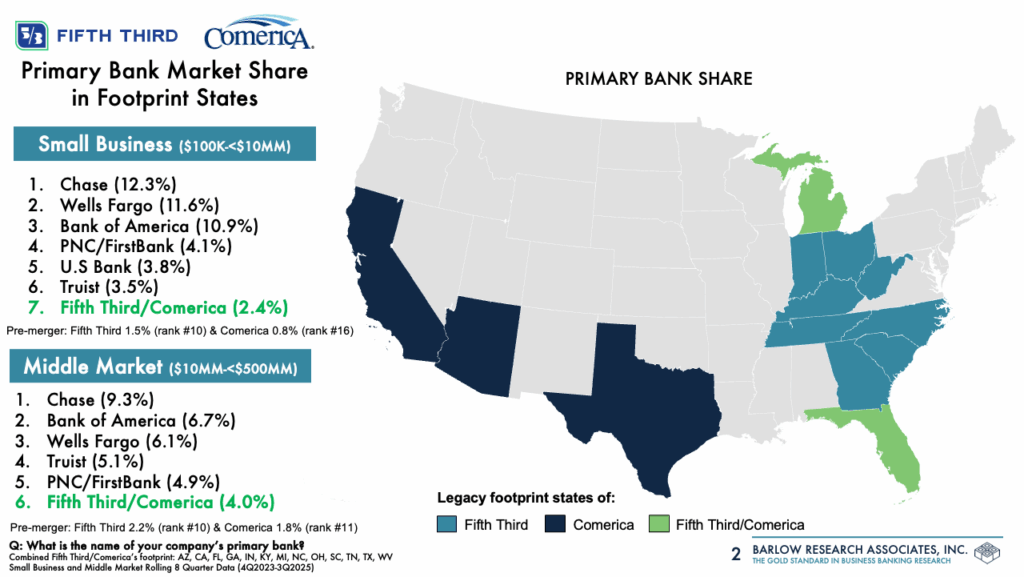

Fifth Third’s and Comerica’s legacy footprints were composed almost entirely of different states, as shown in the graph below. Looking at the joint footprint, we see the same top competitors as in the national results. The new bank increases its primary bank market share rank within the new footprint by three positions in small business and by four positions in middle market. In small business, they take the #7 spot from Fifth Third’s prior tenth place, holding 2% primary share. In middle market, they take the #6 spot from Fifth Third’s prior tenth place, holding 4% primary share. However, Fifth Third will now add to its roster a Top 10 rank position in the critical states of Arizona and Texas in small business, as well as California and Texas in middle market.

Florida and Michigan are the two common states among both institutions’ legacy footprints. In Florida, Fifth Third had the larger primary share pre-merger. In small business, the new bank will remain ranked eighth with 2% primary share (Comerica holding 0%). In the middle market, the new bank will increase its rank to the #16 position with 2% primary share (Fifth Third holding 1.2% and Comerica 0.9%).

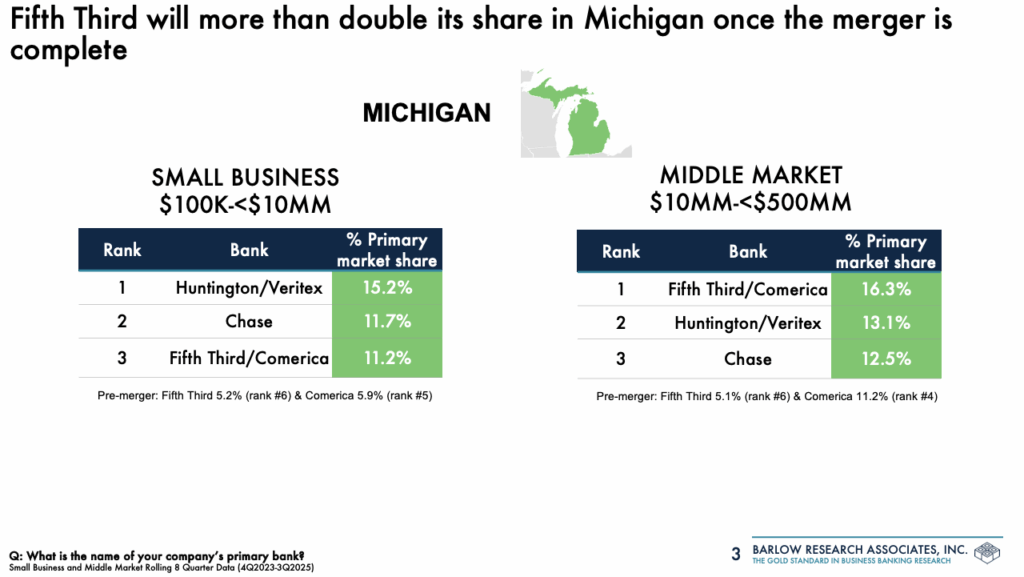

As shown in the graph below, in Michigan, the newly merged bank will increase its rank to the #3 position in small business, with 11% primary share, doubling Fifth Third’s individual share of 5.2% (Comerica currently holds 5.9% individually). In the middle market, the newly merged bank will rise to the #1 position with 16% primary share, tripling Fifth Third’s individual share of 5.1% (Comerica currently holds 11.2%).

Merging of Two Distinct Institutions

Looking at the two segments, Comerica has a stronger primary share position in the middle market, which will help Fifth Third double its share among these larger companies. However, Comerica’s customers in this segment tend to be smaller in sales size and have fewer employees than Fifth Third’s legacy customers. They are also more likely to be in a growth stage of life. In the small business segment, Comerica had lower primary share compared to the middle market segment but still bring an important mix of customers to the new bank. Here, Comerica’s customers were more likely than Fifth Third’s legacy customers to be woman-owned and to be in the services industry. Fifth Third will need to be cognizant of the demographic differences in its new client base and make strategic decisions on how to incorporate clients accustomed to a potentially different service model. As with any merger, the success of the acquisition depends on execution – integrating distinct cultures and technology platforms will be critical to retaining customers.

Please contact us if you are interested in purchasing a Merger Playbook for Fifth Third/Comerica. The Merger Playbook will provide insights into the strengths and opportunities for Fifth Third and Comerica, and an understanding of the new competitive landscape resulting from this merger.

The Merger Playbook: Fifth Third + Comerica will feature:

• Top bank primary market share by state and region, pre- and post-merger

• An analysis of the demographics of Fifth Third’s and Comerica’s customer base

• Key metrics on bank and channel use and satisfaction

• Customer attitudes and opinions

• Account management and customer service experiences

• Product usage and incidence of new product purchases

For more information about the Merger Playbook, please contact insights@barlowresearch.com

For more information about this article, contact Sandy Hanson: (763) 253-1824, shanson@barlowresearch.com