Business Sentiment Steadies as Small Businesses Gain Footing and Middle Market Companies Face Margin Strain

Posted: Sep 4th, 2025

After a turbulent first half of 2025, U.S. businesses appear to be settling into a new phase of cautious optimism as signs of stabilization emerge in Barlow Research’s latest 3Q2025 Economic Pulse Study (this is especially true in the small business segment: companies with $100K-<$10MM in annual sales). The third quarter study finds modest improvement in expectations about overall financial conditions, despite persistent pressure from rising costs, labor challenges and an evolving regulatory climate.

Small Businesses: Glimmers of Improvement Despite Lingering Challenges

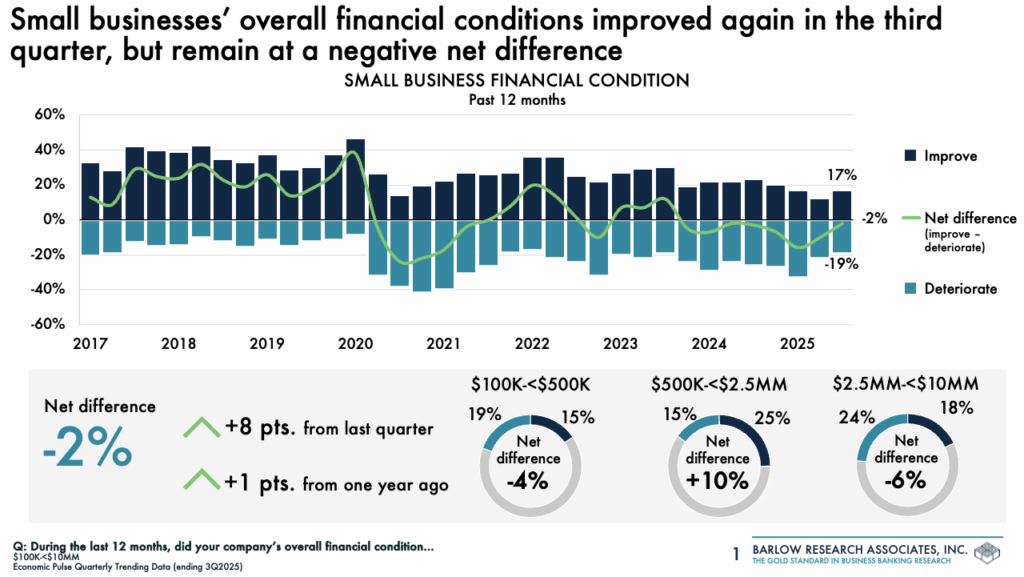

Small businesses showed measurable improvement in key financial indicators. When reflecting on the past year, net difference overall financial conditions (the percentage with deteriorating financial conditions subtracted from those with improved financial conditions) remained slightly negative at -2%. However, this marks an 8-point increase from the second quarter and a second consecutive quarter of growth in a metric that has remained negative since the fourth quarter of 2023 (see chart below). Aided by gains in sales, profits, and excess cash reserves, 62% of small businesses now expect to meet or exceed their financial goals for the year, which is up from 55% in the previous quarter.

One notable shift in small business sentiment came in the area of trade policy. Concerns about tariffs, which topped the list of business anxieties earlier this year, have receded to some degree. Only 51% of small businesses cited tariffs as a moderate or extreme concern, which is down from 61% in the second quarter. However, apprehension about inflation continues to be elevated, with 65% indicating that the cost of doing business is a concerning issue.

Looking ahead, many small business expectations have improved. Most notably, projected financial conditions jumped to a +19% net difference. This is being driven largely by optimism among firms at the upper end of the small business market (companies with $2.5MM-<$10MM in annual revenue). Sales expectations rose six points in Q3; however, expectations about profits remained flat from the previous quarter and substantially lower than projections in 2024. Deflated profit expectations, coupled with an increasing percentage of small businesses that expect to increase their prices, suggests that inflation-driven cost pressures will still be present in the months to come.

Middle Market: Financial Pressures Deepen, but Forward Outlook Improves

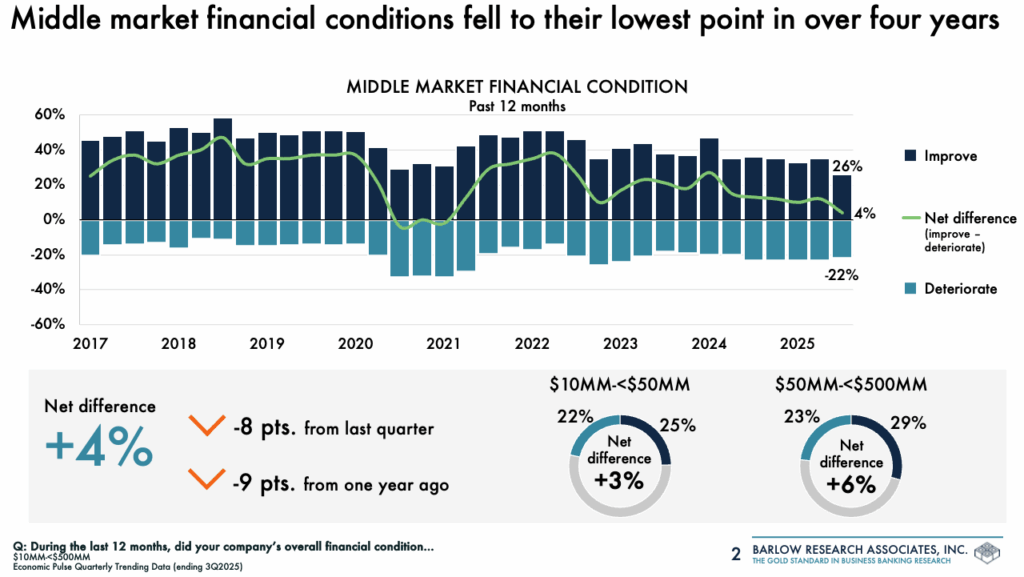

In contrast to the small business segment, middle market (companies with $10MM-<$500MM in sales) financial conditions deteriorated in the third quarter of 2025. Their net difference financial condition declined to +4%, an 8-point drop from 2Q2025 and the lowest level recorded in over four years (since the height of the pandemic). Beneath the deterioration in this metric is margin compression from declining profits and shrinking cash reserves. Nearly four in ten companies reported lower profits, while sales appear to have stagnated. Furthermore, concern over cybersecurity, technology disruption, and hiring challenges has intensified.

Yet, like the small business segment, future expectations have brightened. Expectations about overall financial conditions during the year ahead climbed to +34% net difference. This positivity is bolstered by improving capital expenditure plans and stronger hiring outlooks. Notably, fewer middle market businesses anticipate raising prices in the coming year, hinting at stabilizing input costs.

Credit Demand Split Widens: Small Businesses Pull Back While Middle Market Companies Are Poised for Expansion

Small business and middle markets differ in demand for additional credit. Small business demand for additional credit has fallen to its lowest level in years, with just 12% of businesses applying for additional credit. Many are instead relying on credit cards (26%) or internal funding sources (26%). In fact, only 8% indicated that they used a commercial bank as a source of financing in the past 12 months.

In contrast, middle market demand for additional credit saw a moderate uptick in the third quarter. Twenty-eight percent of middle market companies applied for additional credit in the third quarter, a metric that has remained relatively stable over the past two years. In addition, more than a third of respondents said they plan to apply for additional credit or are unsure. This metric has slowly increased since the end of 2024, indicating that demand for additional credit will likely continue to slowly climb in the next 12 months.

Key Takeaways

The 3Q2025 Economic Pulse paints a picture of a business environment in transition. Small businesses are finding their footing after a prolonged slump, while middle market companies navigate through tightening margins and structural risk. Across the board, growth expectations are improving, but the recovery remains uneven and highly sensitive to cost pressures and macroeconomic volatility.

- Small businesses are stabilizing with improving financial expectations, but inflation and margin pressures remain a concern.

- Middle market firms are strained financially but planning for growth, with stronger future outlooks and rising investment intentions.

- Credit demand is diverging: small businesses are pulling back from borrowing, while middle market companies show renewed interest in financing expansion.

For more information about this article or the Economic Pulse Study, email Joel Mueller at jmueller@barlowresearch.com.