Small Businesses Regaining Momentum and the Middle Market Eyes Growth

Joel Mueller

Posted: Nov 6th, 2025

Businesses appear cautiously optimistic going into 2026, according to Barlow Research’s latest 4Q2025 Economic Pulse Study. Although many small businesses (companies with $100K-<$10MM in annual sales volume) continued to struggle, there are signs that others are looking to begin reinvesting in their companies. Middle market companies ($10MM-<$500MM in annual sales) continue to be hampered by elevated costs, but have become more active in seeking additional credit.

Small business: recent challenges but a more positive outlook

The small business segment has certainly had its challenges in 2025. Only about half (54%) of small businesses expect to meet or exceed their financial goals, down from 62% the prior quarter. When asked about their overall financial condition over the past 12 months, more small businesses have seen deterioration rather than improvement. In fact, small business overall financial conditions have now sat at a negative net difference (the percentage with deteriorating financial conditions subtracted from those with improved financial conditions) for over two years. While recent improvements in sales have been welcome, elevated prices have kept profits deflated.

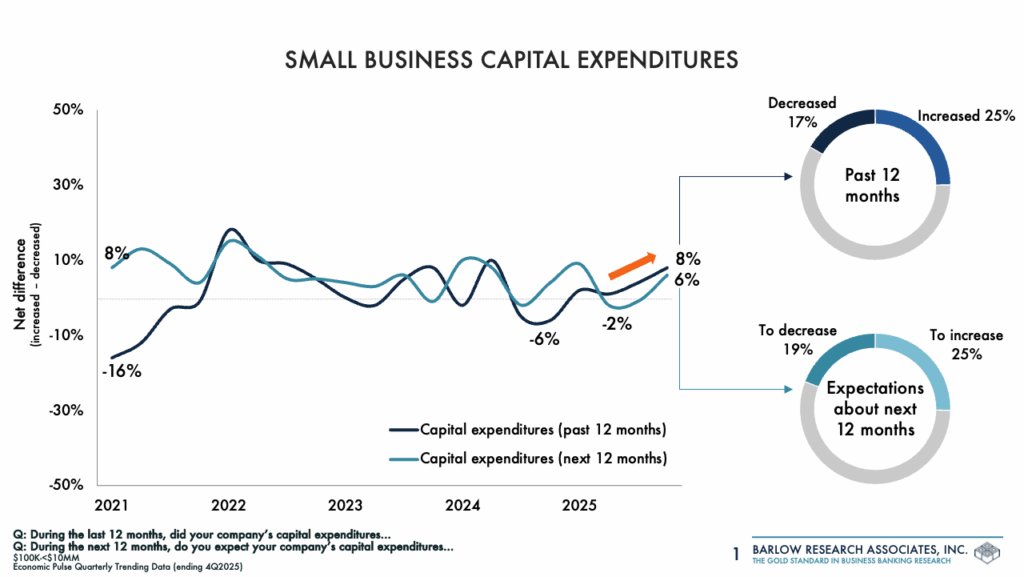

Looking ahead, projected financial conditions held steady at a +19% net difference which is an improvement from a low point in the second quarter of 2025. Improved optimism reflects more positive sales expectations for 2026 (up five points from the third quarter). Profit expectations also improved from a negative net difference in the third quarter. Small businesses are beginning to show signs of reinvestment. Not only have an increasing percentage of small businesses invested in capital expenditures over the past 12 months, but net difference capital expenditure expectations have also increased.

Middle market: high costs persist but improved profits expected

Middle market companies have also had their share of challenges in 2025, even though financial conditions did improve slightly from a low point in the third quarter. The high cost of doing business remains a key challenge in the middle market (72% indicated that the increasing cost of doing business is extremely or moderately concerning). Thirty-eight percent of middle market companies saw decreased profits, while only 24% saw their profits increase (net difference: -14%).

Yet, the outlook for the middle market in 2026 remains positive. Almost half (44%) of companies expect financial conditions to improve in the year ahead, with net difference financial condition expectations holding strong at +31%. Improved profit expectations and stabilizing pricing expectations indicate that pricing pressure in the middle market may be starting to subside. Even with the relatively healthy outlook, net difference hiring expectations were limited and have continued to trend down since the beginning of 2025.

Credit: tale of two segments

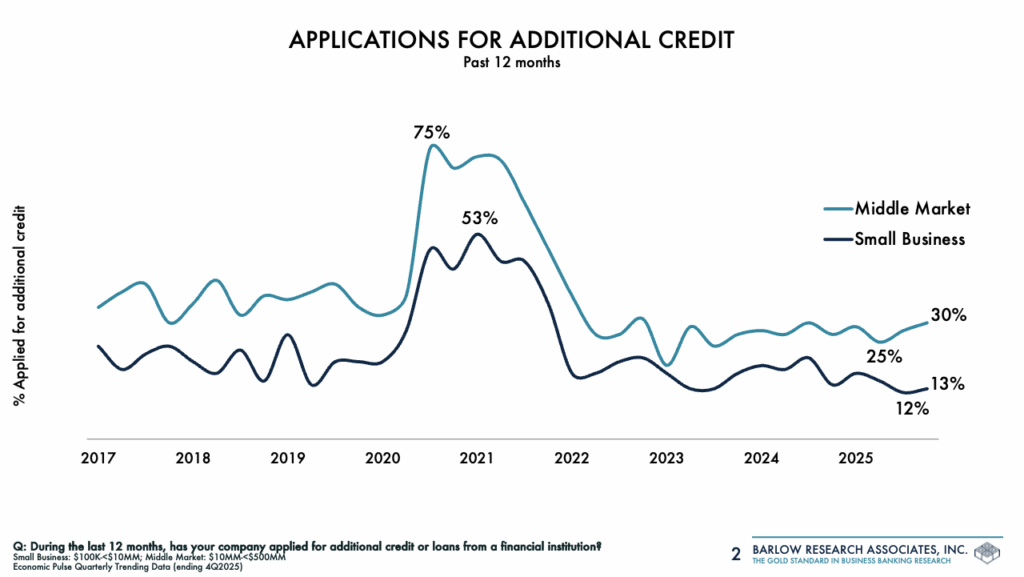

Credit behaviors differ across the small business and middle market segments. Small businesses are increasingly reluctant to take on additional debt, with only 13% applying for additional credit in the past 12 months. This is only one point higher than a low point of 12% in the third quarter. Despite the limited demand, small businesses became increasingly likely to expect to apply for additional credit in the next 12 months. One in four small businesses expected to apply for additional credit or were unsure. Working capital was to top reason that small businesses expect to apply for additional credit.

In contrast, middle market demand for additional credit saw more steady improvement in the fourth quarter, with 30% of companies applying for additional credit. Middle market companies were also substantially more likely to finance their operations through a commercial bank compared to small businesses. Expectations to apply for additional credit remained stable from the third quarter, with 36% expecting to apply for additional credit (or were unsure).

Three key actions to take:

- Engage small businesses ready to reinvest.

There is an indication that a subsegment of small businesses are beginning to spend on capital improvements after two years of financial strain. Proactively discuss financing solutions for equipment, expansion or technology upgrades before competitors capture emerging demand. - Support middle market clients managing cost pressures.

With profitability still constrained by elevated expenses, offer strategic credit structures, treasury solutions or rate management tools that help preserve margins and improve cash flow efficiency. - Differentiate through relationship-driven credit outreach.

Small businesses remain hesitant to borrow, while middle market credit demand is strengthening. Use tailored outreach focused on education, working capital options, and speed of access to re-engage smaller clients and deepen ties with middle market companies.

For more information about this article or the Economic Pulse Study, email Joel Mueller at jmueller@barlowresearch.com.